[ad_1]

On the planet of finance, the place conventional investments like shares and bonds have lengthy been the norm, MicroStrategy’s daring transfer into Bitcoin has stirred vital debate. On the coronary heart of this debate are figures like Peter Schiff, recognized for his skepticism in the direction of cryptocurrencies, and Michael Saylor, CEO of MicroStrategy, who has picked Bitcoin as the way forward for cash.

Shares of #MicroStrategy simply made a brand new 52-week low, down 90% from the record-high in Feb. 2021. Shareholders can pay dearly for @saylor's #Bitcoin obsession. Don't make the error of pondering 90% off is an effective purchase. This isn't only a sale, it's a going-out-of-business sale.

— Peter Schiff (@PeterSchiff) December 29, 2022

MicroStrategy’s Bitcoin Technique: A Monetary Chess Sport or a Ponzi Scheme?

Peter Schiff, a vocal critic of Bitcoin, not too long ago took to X to precise his issues over MicroStrategy’s plans. Schiff identified that on a day when Bitcoin’s value rose, MicroStrategy’s inventory ($MSTR) truly fell by 5.5%.

In response to Schiff, this might point out that Michael Saylor was offloading MSTR shares to purchase extra Bitcoin, thus supporting its value. Schiff framed this as a “shell recreation,” questioning how lengthy this monetary juggling act may proceed with out collapsing like most Ponzi schemes.

Schiff’s critique is rooted in his perception in conventional property like gold, which he argues has intrinsic worth as a result of its utility in varied industries. In distinction, Bitcoin, in Schiff’s view, lacks such utility, making its worth purely speculative. This narrative positions MicroStrategy’s substantial Bitcoin investments as a speculative bubble reasonably than a sound monetary technique.

EXPLORE: Detroit To Accept Crypto For Taxes And Fees In Bid To Attract Blockchain Firms

On the opposite facet, Michael Saylor sees Bitcoin because the apex property of the human race, a digital gold with immense potential for capital preservation. MicroStrategy’s technique underneath Saylor has been to leverage Bitcoin’s finite provide towards the backdrop of an ever-expanding financial base from central banks worldwide. This strategy, Saylor argues, isn’t speculative however a forward-thinking transfer to safeguard towards inflation and the devaluation of fiat currencies. Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

itself is valued at round $107,000 a bit.

America can purchase #Bitcoin and promote Gold.pic.twitter.com/HD69iy1EAO

— Michael Saylor

(@saylor) December 7, 2024

Elliot Wave Principle: Predicting MicroStrategy MSTR Inventory Future?

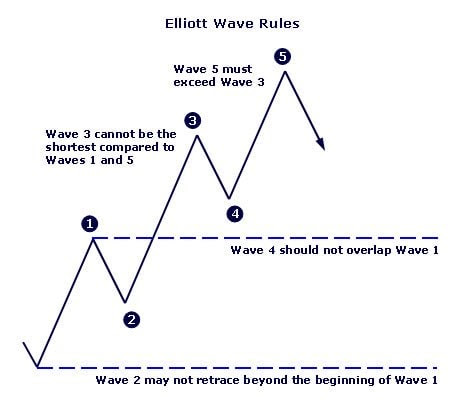

Amidst this monetary tug-of-war, one other perspective emerges from the technical evaluation sphere, significantly by way of the lens of Elliott Wave Principle. This idea, named after Ralph Nelson Elliott, posits that market costs transfer in repetitive patterns or waves, influenced by investor psychology.

(Source)

A tweet by @Freedom_By_40 advised making use of Elliott Wave Principle to research MicroStrategy’s inventory actions. This idea may supply insights into whether or not the inventory’s latest efficiency is an element of a bigger wave sample suggesting future progress or decline. If MicroStrategy’s inventory value drop is a part of a corrective wave, it’d rebound stronger, reflecting a bullish market sentiment towards Bitcoin and, by extension, towards MicroStrategy’s technique.

$MSTR detailed rely for remainder of cycle.

For many who are new right here please don’t pay as a lot consideration to the time as the worth (the time is only a greatest guess projection as EW isn’t time based mostly however value based mostly). https://t.co/rU3b4xTLEr pic.twitter.com/SUNCckzpVR

— Freedom By 40 (@Freedom_By_40) December 18, 2024

Nevertheless, if this drop indicators the start of a bearish wave, it’d point out that the market is dropping religion in Bitcoin’s long-term worth proposition or in MicroStrategy technique to again its monetary stability with Bitcoin. Such evaluation could possibly be essential for buyers making an attempt to foretell the sustainability of MicroStrategy’s strategy to navigating the unstable cryptocurrency market.

The talk over MicroStrategy’s Bitcoin funding technique encapsulates broader questions on the way forward for cash and funding. Peter Schiff’s critique highlights the dangers of speculative bubbles, whereas Michael Saylor’s advocacy for Bitcoin underscores a imaginative and prescient of digital property remodeling conventional finance. In the meantime, instruments just like the Elliott Wave Principle supply a strategy to predict potential outcomes based mostly on historic market conduct.

EXPLORE: 11 Best AI Crypto Coins to Invest in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Decoding MicroStrategy’s Bitcoin Strategy: Ponzi Scheme or Genius Investment? appeared first on 99Bitcoins.

[ad_2]

Source link