[ad_1]

Proof of stake continues to be one of the controversial discussions within the cryptocurrency house. Though the concept has many simple advantages, together with effectivity, a bigger safety margin and future-proof immunity to {hardware} centralization issues, proof of stake algorithms are typically considerably extra advanced than proof of work-based options, and there’s a great amount of skepticism that proof of stake can work in any respect, notably with regard to the supposedly elementary “nothing at stake” drawback. Because it seems, nevertheless, the issues are solvable, and one could make a rigorous argument that proof of stake, with all its advantages, might be made to achieve success – however at a reasonable value. The aim of this submit might be to elucidate precisely what this value is, and the way its affect might be minimized.

Financial Units and Nothing at Stake

First, an introduction. The aim of a consensus algorithm, typically, is to permit for the safe updating of a state in accordance with some particular state transition guidelines, the place the proper to carry out the state transitions is distributed amongst some financial set. An financial set is a set of customers which might be given the proper to collectively carry out transitions through some algorithm, and the vital property that the financial set used for consensus must have is that it have to be securely decentralized – that means that no single actor, or colluding set of actors, can take up nearly all of the set, even when the actor has a pretty big quantity of capital and monetary incentive. To date, we all know of three securely decentralized financial units, and every financial set corresponds to a set of consensus algorithms:

- Homeowners of computing energy: normal proof of labor, or TaPoW. Notice that this is available in specialised {hardware}, and (hopefully) general-purpose {hardware} variants.

- Stakeholders: the entire many variants of proof of stake

- A consumer’s social community: Ripple/Stellar-style consensus

Notice that there have been some latest makes an attempt to develop consensus algorithms primarily based on traditional Byzantine fault tolerance concept; nevertheless, all such approaches are primarily based on an M-of-N safety mannequin, and the idea of “Byzantine fault tolerance” by itself nonetheless leaves open the query of which set the N needs to be sampled from. Normally, the set used is stakeholders, so we’ll deal with such neo-BFT paradigms are merely being intelligent subcategories of “proof of stake”.

Proof of labor has a pleasant property that makes it a lot easier to design efficient algorithms for it: participation within the financial set requires the consumption of a useful resource exterior to the system. Which means that, when contributing one’s work to the blockchain, a miner should make the selection of which of all potential forks to contribute to (or whether or not to attempt to begin a brand new fork), and the totally different choices are mutually unique. Double-voting, together with double-voting the place the second vote is made a few years after the primary, is unprofitablem because it requires you to separate your mining energy among the many totally different votes; the dominant technique is all the time to place your mining energy completely on the fork that you just suppose is probably to win.

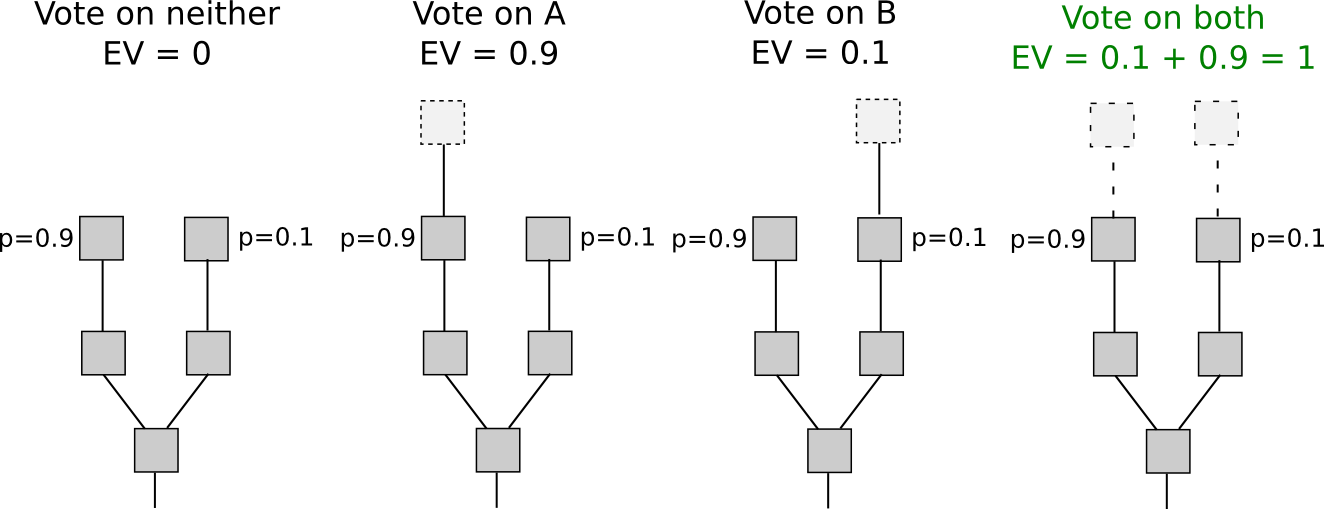

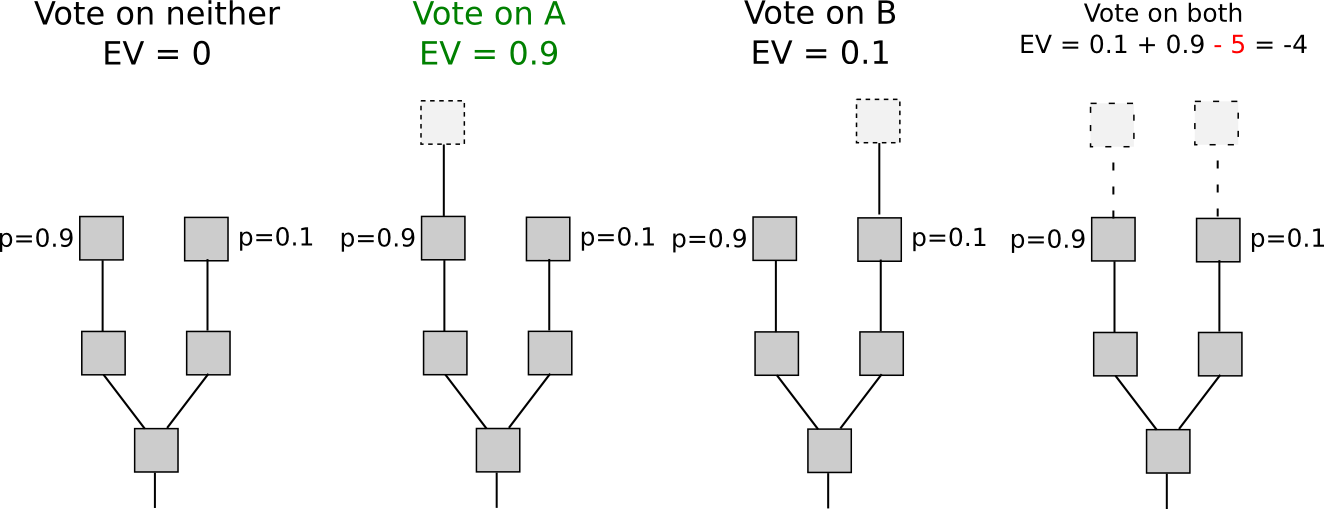

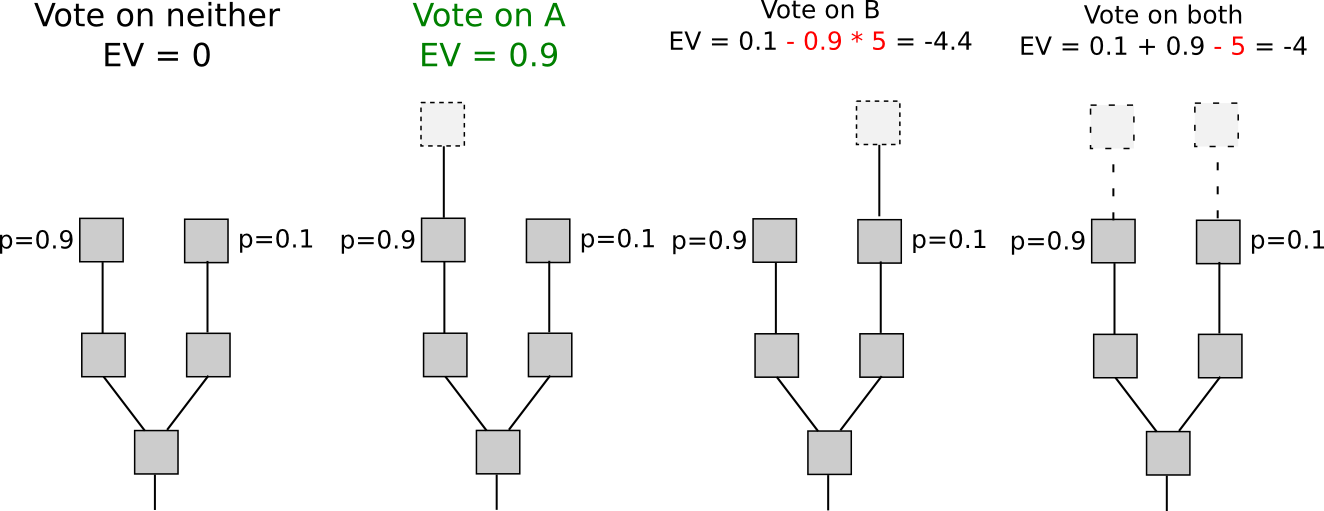

With proof of stake, nevertheless, the scenario is totally different. Though inclusion into the financial set could also be pricey (though as we’ll see it not all the time is), voting is free. Which means that “naive proof of stake” algorithms, which merely attempt to copy proof of labor by making each coin a “simulated mining rig” with a sure probability per second of constructing the account that owns it usable for signing a block, have a deadly flaw: if there are a number of forks, the optimum technique is to vote on all forks without delay. That is the core of “nothing at stake”.

Notice that there’s one argument for why it won’t make sense for a consumer to vote on one fork in a proof-of-stake atmosphere: “altruism-prime”. Altruism-prime is actually the mixture of precise altruism (on the a part of customers or software developers), expressed each as a direct concern for the welfare of others and the community and a psychological ethical disincentive towards doing one thing that’s clearly evil (double-voting), in addition to the “pretend altruism” that happens as a result of holders of cash have a need to not see the worth of their cash go down.

Sadly, altruism-prime can’t be relied on completely, as a result of the worth of cash arising from protocol integrity is a public good and can thus be undersupplied (eg. if there are 1000 stakeholders, and every of their exercise has a 1% probability of being “pivotal” in contributing to a profitable assault that may knock coin worth right down to zero, then every stakeholder will settle for a bribe equal to only one% of their holdings). Within the case of a distribution equal to the Ethereum genesis block, relying on the way you estimate the chance of every consumer being pivotal, the required amount of bribes can be equal to someplace between 0.3% and eight.6% of whole stake (and even much less if an assault is nonfatal to the foreign money). Nevertheless, altruism-prime continues to be an vital idea that algorithm designers ought to be mindful, in order to take maximal benefit of in case it really works properly.

Quick and Lengthy Vary

If we focus our consideration particularly on short-range forks – forks lasting lower than some variety of blocks, maybe 3000, then there truly is an answer to the nothing at stake drawback: safety deposits. So as to be eligible to obtain a reward for voting on a block, the consumer should put down a safety deposit, and if the consumer is caught both voting on a number of forks then a proof of that transaction might be put into the unique chain, taking the reward away. Therefore, voting for under a single fork as soon as once more turns into the dominant technique.

One other set of methods, known as “Slasher 2.0” (in distinction to Slasher 1.0, the unique safety deposit-based proof of stake algorithm), entails merely penalizing voters that vote on the incorrect fork, not voters that double-vote. This makes evaluation considerably easier, because it removes the necessity to pre-select voters many blocks upfront to forestall probabilistic double-voting methods, though it does have the price that customers could also be unwilling to signal something if there are two options of a block at a given top. If we need to give customers the choice to check in such circumstances, a variant of logarithmic scoring rules can be utilized (see here for extra detailed investigation). For the needs of this dialogue, Slasher 1.0 and Slasher 2.0 have equivalent properties.

The rationale why this solely works for short-range forks is easy: the consumer has to have the proper to withdraw the safety deposit ultimately, and as soon as the deposit is withdrawn there isn’t any longer any incentive to not vote on a long-range fork beginning far again in time utilizing these cash. One class of methods that try to cope with that is making the deposit everlasting, however these approaches have an issue of their very own: until the worth of a coin continuously grows in order to repeatedly admit new signers, the consensus set finally ends up ossifying right into a type of everlasting the Aristocracy. On condition that one of many most important ideological grievances that has led to cryptocurrency’s recognition is exactly the truth that centralization tends to ossify into nobilities that retain everlasting energy, copying such a property will probably be unacceptable to most customers, no less than for blockchains that should be everlasting. A the Aristocracy mannequin could be exactly the proper strategy for special-purpose ephemeral blockchains that should die rapidly (eg. one may think such a blockchain current for a spherical of a blockchain-based sport).

One class of approaches at fixing the issue is to mix the Slasher mechanism described above for short-range forks with a backup, transactions-as-proof-of-stake, for lengthy vary forks. TaPoS primarily works by counting transaction charges as a part of a block’s “rating” (and requiring each transaction to incorporate some bytes of a latest block hash to make transactions not trivially transferable), the idea being {that a} profitable assault fork should spend a big amount of charges catching up. Nevertheless, this hybrid strategy has a elementary flaw: if we assume that the chance of an assault succeeding is near-zero, then each signer has an incentive to supply a service of re-signing all of their transactions onto a brand new blockchain in trade for a small payment; therefore, a zero chance of assaults succeeding shouldn’t be game-theoretically steady. Does each consumer organising their very own node.js webapp to just accept bribes sound unrealistic? Properly, in that case, there is a a lot simpler manner of doing it: promote outdated, no-longer-used, non-public keys on the black market. Even with out black markets, a proof of stake system would eternally be below the specter of the people that initially participated within the pre-sale and had a share of genesis block issuance ultimately discovering one another and coming collectively to launch a fork.

Due to all of the arguments above, we are able to safely conclude that this menace of an attacker build up a fork from arbitrarily lengthy vary is sadly elementary, and in all non-degenerate implementations the difficulty is deadly to a proof of stake algorithm’s success within the proof of labor safety mannequin. Nevertheless, we are able to get round this elementary barrier with a slight, however nonetheless elementary, change within the safety mannequin.

Weak Subjectivity

Though there are numerous methods to categorize consensus algorithms, the division that we are going to give attention to for the remainder of this dialogue is the next. First, we’ll present the 2 commonest paradigms right now:

- Goal: a brand new node coming onto the community with no data besides (i) the protocol definition and (ii) the set of all blocks and different “vital” messages which were printed can independently come to the very same conclusion as the remainder of the community on the present state.

- Subjective: the system has steady states the place totally different nodes come to totally different conclusions, and a considerable amount of social info (ie. fame) is required with a view to take part.

Programs that use social networks as their consensus set (eg. Ripple) are all essentially subjective; a brand new node that is aware of nothing however the protocol and the information might be satisfied by an attacker that their 100000 nodes are reliable, and with out fame there isn’t any option to cope with that assault. Proof of labor, however, is goal: the present state is all the time the state that comprises the best anticipated quantity of proof of labor.

Now, for proof of stake, we’ll add a 3rd paradigm:

- Weakly subjective: a brand new node coming onto the community with no data besides (i) the protocol definition, (ii) the set of all blocks and different “vital” messages which were printed and (iii) a state from lower than N blocks in the past that’s recognized to be legitimate can independently come to the very same conclusion as the remainder of the community on the present state, until there’s an attacker that completely has greater than X % management over the consensus set.

Below this mannequin, we are able to clearly see how proof of stake works completely positive: we merely forbid nodes from reverting greater than N blocks, and set N to be the safety deposit size. That’s to say, if state S has been legitimate and has develop into an ancestor of no less than N legitimate states, then from that time on no state S’ which isn’t a descendant of S might be legitimate. Lengthy-range assaults are not an issue, for the trivial purpose that we have now merely stated that long-range forks are invalid as a part of the protocol definition. This rule clearly is weakly subjective, with the added bonus that X = 100% (ie. no assault may cause everlasting disruption until it lasts greater than N blocks).

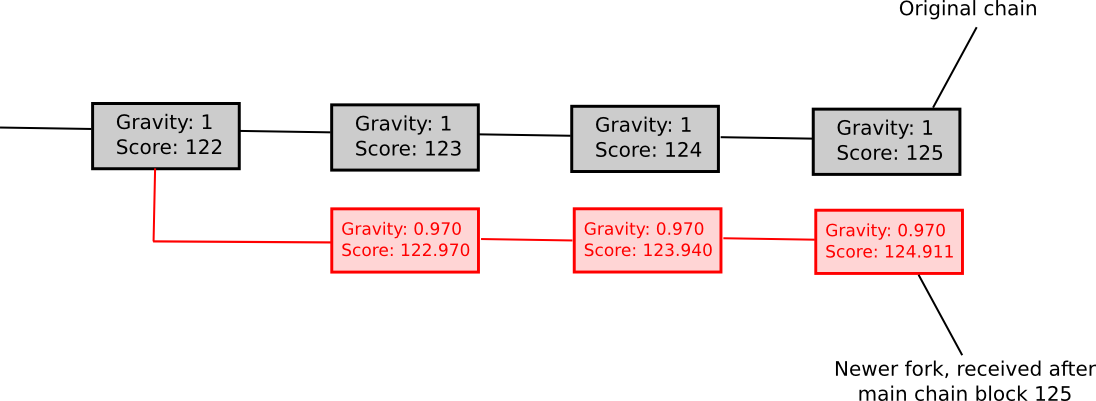

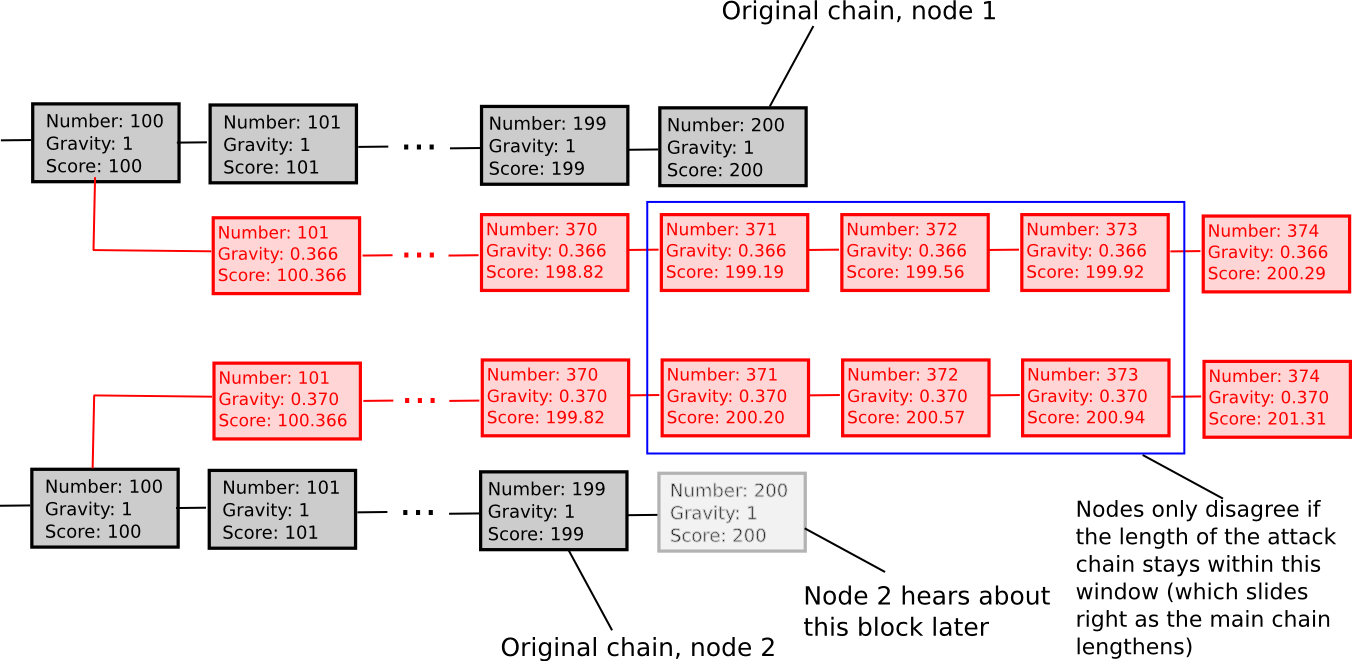

One other weakly subjective scoring technique is exponential subjective scoring, outlined as follows:

- Each state S maintains a “rating” and a “gravity”

- rating(genesis) = 0, gravity(genesis) = 1

- rating(block) = rating(block.dad or mum) + weight(block) * gravity(block.dad or mum), the place weight(block) is often 1, although extra superior weight capabilities will also be used (eg. in Bitcoin, weight(block) = block.issue can work properly)

- If a node sees a brand new block B’ with B as dad or mum, then if n is the size of the longest chain of descendants from B at the moment, gravity(B’) = gravity(B) * 0.99 ^ n (be aware that values apart from 0.99 will also be used).

Primarily, we explicitly penalize forks that come later. ESS has the property that, in contrast to extra naive approaches at subjectivity, it largely avoids everlasting community splits; if the time between the primary node on the community listening to about block B and the final node on the community listening to about block B is an interval of ok blocks, then a fork is unsustainable until the lengths of the 2 forks stay eternally inside roughly ok % of one another (if that’s the case, then the differing gravities of the forks will be certain that half of the community will eternally see one fork as higher-scoring and the opposite half will help the opposite fork). Therefore, ESS is weakly subjective with X roughly comparable to how near a 50/50 community break up the attacker can create (eg. if the attacker can create a 70/30 break up, then X = 0.29).

Normally, the “max revert N blocks” rule is superior and fewer advanced, however ESS might show to make extra sense in conditions the place customers are positive with excessive levels of subjectivity (ie. N being small) in trade for a fast ascent to very excessive levels of safety (ie. proof against a 99% assault after N blocks).

Penalties

So what would a world powered by weakly subjective consensus seem like? Initially, nodes which might be all the time on-line can be positive; in these instances weak subjectivity is by definition equal to objectivity. Nodes that pop on-line infrequently, or no less than as soon as each N blocks, would even be positive, as a result of they’d have the ability to continuously get an up to date state of the community. Nevertheless, new nodes becoming a member of the community, and nodes that seem on-line after a really very long time, wouldn’t have the consensus algorithm reliably defending them. Fortuitously, for them, the answer is easy: the primary time they enroll, and each time they keep offline for a really very very long time, they want solely get a latest block hash from a good friend, a blockchain explorer, or just their software program supplier, and paste it into their blockchain shopper as a “checkpoint”. They are going to then have the ability to securely replace their view of the present state from there.

This safety assumption, the concept of “getting a block hash from a good friend”, could appear unrigorous to many; Bitcoin builders usually make the purpose that if the answer to long-range assaults is a few different deciding mechanism X, then the safety of the blockchain in the end is dependent upon X, and so the algorithm is in actuality no safer than utilizing X straight – implying that the majority X, together with our social-consensus-driven strategy, are insecure.

Nevertheless, this logic ignores why consensus algorithms exist within the first place. Consensus is a social course of, and human beings are pretty good at participating in consensus on our personal with none assist from algorithms; maybe the very best instance is the Rai stones, the place a tribe in Yap primarily maintained a blockchain recording adjustments to the possession of stones (used as a Bitcoin-like zero-intrinsic-value asset) as a part of its collective reminiscence. The rationale why consensus algorithms are wanted is, fairly merely, as a result of people do not have infinite computational power, and like to depend on software program brokers to keep up consensus for us. Software program brokers are very sensible, within the sense that they’ll preserve consensus on extraordinarily massive states with extraordinarily advanced rulesets with excellent precision, however they’re additionally very ignorant, within the sense that they’ve little or no social info, and the problem of consensus algorithms is that of making an algorithm that requires as little enter of social info as potential.

Weak subjectivity is precisely the proper resolution. It solves the long-range issues with proof of stake by counting on human-driven social info, however leaves to a consensus algorithm the function of accelerating the pace of consensus from many weeks to 12 seconds and of permitting using extremely advanced rulesets and a big state. The function of human-driven consensus is relegated to sustaining consensus on block hashes over lengthy intervals of time, one thing which persons are completely good at. A hypothetical oppressive authorities which is highly effective sufficient to really trigger confusion over the true worth of a block hash from one 12 months in the past would even be highly effective sufficient to overpower any proof of labor algorithm, or trigger confusion in regards to the guidelines of blockchain protocol.

Notice that we don’t want to repair N; theoretically, we are able to provide you with an algorithm that permits customers to maintain their deposits locked down for longer than N blocks, and customers can then make the most of these deposits to get a way more fine-grained studying of their safety stage. For instance, if a consumer has not logged in since T blocks in the past, and 23% of deposits have time period size higher than T, then the consumer can provide you with their very own subjective scoring perform that ignores signatures with newer deposits, and thereby be safe towards assaults with as much as 11.5% of whole stake. An rising rate of interest curve can be utilized to incentivize longer-term deposits over shorter ones, or for simplicity we are able to simply depend on altruism-prime.

Marginal Price: The Different Objection

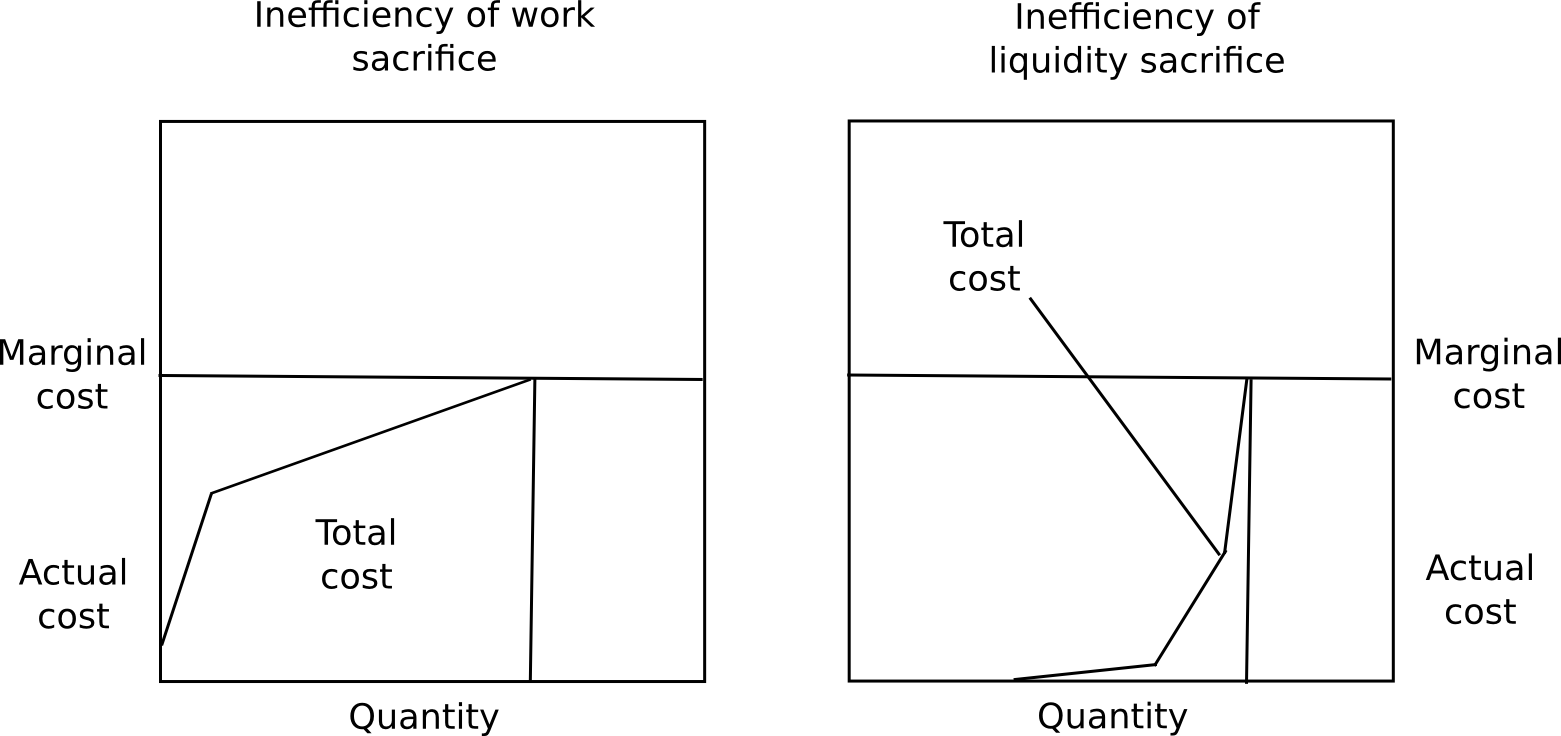

One objection to long-term deposits is that it incentivizes customers to maintain their capital locked up, which is inefficient, the very same drawback as proof of labor. Nevertheless, there are 4 counterpoints to this.

First, marginal value shouldn’t be whole value, and the ratio of whole value divided by marginal value is far much less for proof of stake than proof of labor. A consumer will probably expertise near no ache from locking up 50% of their capital for a number of months, a slight quantity of ache from locking up 70%, however would discover locking up greater than 85% insupportable with out a big reward. Moreover, totally different customers have very totally different preferences for the way keen they’re to lock up capital. Due to these two elements put collectively, no matter what the equilibrium rate of interest finally ends up being, the overwhelming majority of the capital might be locked up at far under marginal value.

Second, locking up capital is a non-public value, but additionally a public good. The presence of locked up capital means that there’s much less cash provide out there for transactional functions, and so the worth of the foreign money will improve, redistributing the capital to everybody else, making a social profit. Third, safety deposits are a really secure retailer of worth, so (i) they substitute using cash as a private disaster insurance coverage instrument, and (ii) many customers will have the ability to take out loans in the identical foreign money collateralized by the safety deposit. Lastly, as a result of proof of stake can truly take away deposits for misbehaving, and never simply rewards, it’s able to attaining a stage of safety a lot larger than the extent of rewards, whereas within the case of proof of labor the extent of safety can solely equal the extent of rewards. There isn’t a manner for a proof of labor protocol to destroy misbehaving miners’ ASICs.

Fortuitously, there’s a option to take a look at these assumptions: launch a proof of stake coin with a stake reward of 1%, 2%, 3%, and many others per 12 months, and see simply how massive a share of cash develop into deposits in every case. Customers won’t act towards their very own pursuits, so we are able to merely use the amount of funds spent on consensus as a proxy for the way a lot inefficiency the consensus algorithm introduces; if proof of stake has an inexpensive stage of safety at a a lot decrease reward stage than proof of labor, then we all know that proof of stake is a extra environment friendly consensus mechanism, and we are able to use the degrees of participation at totally different reward ranges to get an correct concept of the ratio between whole value and marginal value. Finally, it might take years to get an actual concept of simply how massive the capital lockup prices are.

Altogether, we now know for sure that (i) proof of stake algorithms might be made safe, and weak subjectivity is each ample and mandatory as a elementary change within the safety mannequin to sidestep nothing-at-stake issues to perform this purpose, and (ii) there are substantial financial causes to consider that proof of stake truly is way more economically environment friendly than proof of labor. Proof of stake shouldn’t be an unknown; the previous six months of formalization and analysis have decided precisely the place the strengths and weaknesses lie, no less than to as massive extent as with proof of labor, the place mining centralization uncertainties might properly eternally abound. Now, it is merely a matter of standardizing the algorithms, and giving blockchain builders the selection.

[ad_2]

Source link