[ad_1]

One of many key properties that’s normally hunted for in a cryptoeconomic algorithm, whether or not a blockchain consensus algorithm such a proof of labor or proof of stake, a popularity system or a buying and selling course of for one thing like knowledge transmission or file storage, is the best of incentive-compatibility – the concept it needs to be in everybody’s financial curiosity to truthfully observe the protocol. The important thing underlying assumption on this aim is the concept individuals (or extra exactly on this case nodes) are “rational” – that’s to say, that individuals have a comparatively easy outlined set of goals and observe the optimum technique to maximise their achievement of these goals. In game-theoretic protocol design, that is normally simplified to saying that individuals like cash, since cash is the one factor that can be utilized to assist additional one’s success in virtually any goal. In actuality, nonetheless, this isn’t exactly the case.

People, and even the de-facto human-machine hybrids which might be the individuals of protocols like Bitcoin and Ethereum, will not be completely rational, and there are particular deviations from rationality which might be so prevalent amongst customers that they can’t be merely categorized as “noise”. Within the social sciences, economics has responded to this concern with the subfield of behavioral economics, which mixes experimental research with a set of recent theoretical ideas together with prospect theory, bounded rationality, defaults and heuristics, and has succeeded in making a mannequin which in some instances significantly extra precisely fashions human conduct.

Within the context of cryptographic protocols, rationality-based analyses are arguably equally suboptimal, and there are explicit parallels between a few of the ideas; for instance, as we’ll later see, “software program” and “heuristic” are basically synonyms. One other focal point is the truth that we arguably don’t even have an correct mannequin of what constitutes an “agent”, an perception that has explicit significance to protocols that attempt to be “trust-free” or have “no single level of failure”.

Conventional fashions

In conventional fault-tolerance concept, there are three sorts of fashions which might be used for figuring out how nicely a decentralized system can survive elements of it deviating from the protocol, whether or not on account of malice or easy failure. The primary of those is easy fault tolerance. In a easy fault tolerant system, the thought is that each one elements of the system could be trusted to do both of two issues: precisely observe the protocol, or fail. The system needs to be designed to detect failures and get well and route round them in some trend. Easy fault tolerance is normally the very best mannequin for evaluating methods which might be politically centralized, however architecturally decentralized; for instance, Amazon or Google’s cloud internet hosting. The system ought to positively have the ability to deal with one server going offline, however the designers don’t want to consider one of many servers changing into evil (if that does occur, then an outage is appropriate till the Amazon or Google staff manually work out what’s going on and shut that server down).

Nonetheless, easy fault tolerance is just not helpful for describing methods that aren’t simply architecturally, but in addition politically, decentralized. What if we’ve got a system the place we need to be fault-tolerant in opposition to some elements of the system misacting, however the elements of the system could be managed by totally different organizations or people, and you don’t belief all of them to not be malicious (though you do belief that no less than, say, two thirds of them will act truthfully)? On this case, the mannequin we wish is Byzantine fault tolerance (named after the Byzantine Generals Problem) – most nodes will truthfully observe the protocol, however some will deviate, they usually can deviate in any means; the belief is that each one deviating nodes are colluding to screw you over. A Byzantine-fault-tolerant protocol ought to survive in opposition to a restricted variety of such deviations.

For an instance of easy and Byzantine fault-tolerance in motion, an excellent use case is decentralized file storage.

Past these two situations, there may be additionally one other much more refined mannequin: the Byzantine/Altruistic/Rational model. The BAR mannequin improves upon the Byzantine mannequin by including a easy realization: in actual life, there isn’t a sharp distinction between “trustworthy” and “dishonest” individuals; everyone seems to be motivated by incentives, and if the incentives are excessive sufficient then even nearly all of individuals could nicely act dishonestly – notably if the protocol in query weights individuals’s affect by financial energy, as just about all protocols do within the blockchain area. Thus, the BAR mannequin assumes three forms of actors:

- Altruistic – altruistic actors all the time observe the protocol

- Rational – rational actors observe the protocol if it fits them, and don’t observe the protocol if it doesn’t

- Byzantine – Byzantine actors are all conspiring to screw you over

In observe, protocol builders are typically uncomfortable assuming any particular nonzero amount of altruism, so the mannequin that many protocols are judged by is the even harsher “BR” mannequin; protocols that survive underneath BR are mentioned to be incentive-compatible (something that survives underneath BR survives underneath BAR, since an altruist is assured to be no less than pretty much as good for the well being of the protocol as anybody else as benefitting the protocol is their express goal).

Word that these are worst-case situations that the system should survive, not correct descriptions of actuality always

To see how this mannequin works, allow us to look at an argument for why Bitcoin is incentive-compatible. The a part of Bitcoin that we care most about is the mining protocol, with miners being the customers. The “right” technique outlined within the protocol is to all the time mine on the block with the best “rating”, the place rating is roughly outlined as follows:

- If a block is the genesis block, rating(B) = 0

- If a block is invalid, rating(B) = -infinity

- In any other case, rating(B) = rating(B.dad or mum) + 1

In observe, the contribution that every block makes to the entire rating varies with problem, however we are able to ignore such subtleties in our easy evaluation. If a block is efficiently mined, then the miner receives a reward of fifty BTC. On this case, we are able to see that there are precisely three Byzantine methods:

- Not mining in any respect

- Mining on a block aside from the block with highest rating

- Attempting to supply an invalid block

The argument in opposition to (1) is easy: if you happen to do not mine, you aren’t getting the reward. Now, let us take a look at (2) and (3). In case you observe the proper technique, you might have a likelihood p of manufacturing a legitimate block with rating s + 1 for some s. In case you observe a Byzantine technique, you might have a likelihood p of manufacturing a legitimate block with rating q + 1 with q < s (and if you happen to attempt to produce an invalid block, you might have a likelihood of manufacturing some block with rating damaging infinity). Thus, your block is just not going to be the block with the best rating, so different miners will not be going to mine on it, so your mining reward won’t be a part of the eventual longest chain. Word that this argument doesn’t depend upon altruism; it solely is determined by the concept you might have an incentive to maintain in line if everybody else does – a basic Schelling point argument.

The most effective technique to maximise the prospect that your block will get included within the eventual successful blockchain is to mine on the block that has the best rating.

Belief-Free Programs

One other essential class of cryptoeconomic protocols is the set of so-called “trust-free” centralized protocols. Of those, there are just a few main classes:

Provably honest playing

One of many large issues in on-line lotteries and playing websites is the potential for operator fraud, the place the operator of the positioning would barely and imperceptibly “load the cube” of their favor. A serious good thing about cryptocurrency is its skill to take away this drawback by setting up a playing protocol that’s auditable, so any such deviation could be in a short time detected. A tough define of a provably honest playing protocol is as follows:

- Originally of every day, the positioning generates a seed s and publishes H(s) the place H is a few normal hash operate (eg. SHA3)

- When a person sends a transaction to make a wager, the “cube roll” is calculated utilizing H(s + TX) mod n the place TX is the transaction used to pay for the wager and n is the variety of potential outcomes (eg. if it is a 6-sided die, n = 6, for a lottery with a 1 in 927 likelihood of successful, n = 927 and successful video games are video games the place H(s + TX) mod 927 = 0).

- On the finish of the day, the positioning publishes s.

Customers can then confirm that (1) the hash supplied in the beginning of the day really is H(s), and (2) that the outcomes of the bets really match the formulation. Thus, a playing web site following this protocol has no means of dishonest with out getting caught inside 24 hours; as quickly because it generates s and must publish a worth H(s) it’s principally certain to observe the exact protocol appropriately.

Proof of Solvency

One other software of cryptography is the idea of making auditable monetary companies (technically, playing is a monetary service, however right here we’re concerned about companies that maintain your cash, not simply briefly manipulate it). There are strong theoretical arguments and empirical evidence that monetary companies of that kind are more likely to attempt to cheat their customers; maybe probably the most parcticularly jarring instance is the case of MtGox, a Bitcoin alternate which shut down with over 600,000 BTC of buyer funds lacking.

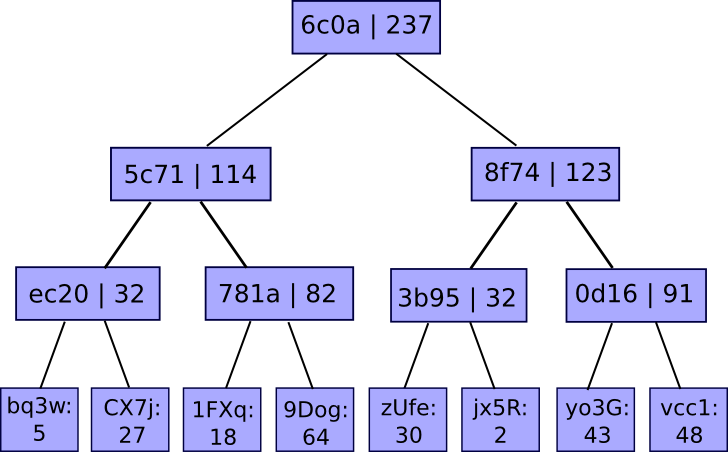

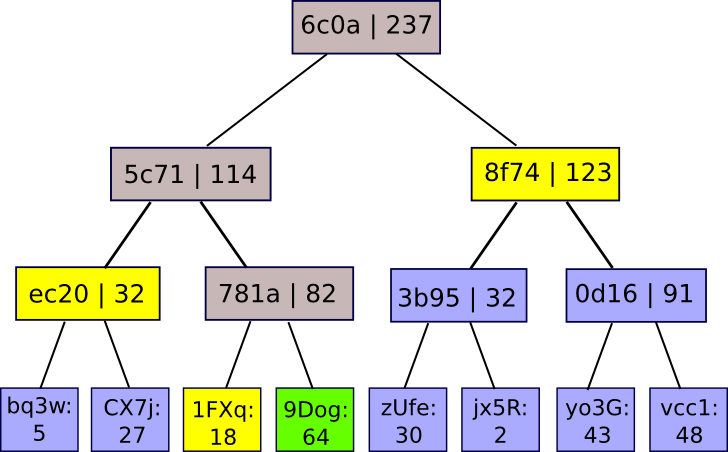

The thought behind proof of solvency is as follows. Suppose there may be an alternate with customers U[1] … U[n] the place person U[i] has steadiness b[i]. The sum of all balances is B. The alternate desires to show that it really has the bitcoins to cowl everybody’s balances. This can be a two-part drawback: the alternate should concurrently show that for some B it’s true that (1) the sum of customers’ balances is B, and (ii) the alternate is in possession of no less than B BTC. The second is straightforward to show; simply signal a message with the personal key that holds the bitcoins on the time. The only approach to show the primary is to only publish everybody’s balances, and let individuals verify that their balances match the general public values, however this compromises privateness; therefore, a greater technique is required.

The answer includes, as usual, a Merkle tree – besides on this case it is a funky enhanced form of Merkle tree referred to as a “Merkle sum tree”. As a substitute of every node merely being the hash of its youngsters, each node incorporates the hash of its youngsters and the sum of the values of its youngsters:

The values on the backside are mappings of account IDs to balances. The service publishes the basis of the tree, and if a person desires a proof that their account is appropriately included within the tree, the service can merely give them the department of the tree equivalent to their account:

There are two ways in which the positioning can cheat, and attempt to get away with having a fractional reserve. First, it could attempt to have one of many nodes within the Merkle tree incorrectly sum the values of its youngsters. On this case, as quickly as a person requests a department containing that node they are going to know that one thing is unsuitable. Second, it could attempt to insert damaging values into the leaves of the tree. Nonetheless, if it does this, then except the positioning supplies pretend optimistic and damaging nodes that cancel one another out (thus defeating the entire level), then there might be no less than one official person whose Merkle department will comprise the damaging worth; generally, getting away with having X p.c lower than the required reserve requires relying on a selected X p.c of customers by no means performing the audit process – a consequence that’s really the very best that any protocol can do, on condition that an alternate can all the time merely zero out some proportion of its customers’ account balances if it is aware of that they are going to by no means uncover the fraud.

Multisig

A 3rd software, and an important one, is multisig, or extra typically the idea of multi-key authorization. As a substitute of your account being managed by one personal key which can get hacked, there are three keys, of which two are wanted to entry the account (or another configuration, maybe involving withdrawal limits or time-locked withdrawals; Bitcoin doesn’t assist such options however extra superior methods do). The way in which multisig is normally carried out thus far is as a 2-of-3: you might have one key, the server has one key, and you’ve got a 3rd backup key in a secure place. In the midst of regular exercise, if you signal a transaction you typically signal it together with your key regionally, then ship it to the server. The server performs some second verification course of – maybe consisting of sending a affirmation code to your cellphone, and if it confirms that you simply meant to ship the transaction then it indicators it as nicely.

The thought is that such a system is tolerant in opposition to any single fault, together with any single Byzantine fault. In case you lose your password, you might have a backup, which along with the server can get well your funds, and in case your password is hacked, the attacker solely has one password; likewise for loss or theft of the backup. If the service disappears, you might have two keys. If the service is hacked or seems to be evil, it solely has one. The likelihood of two failures taking place on the identical time may be very small; arguably, you usually tend to die.

Elementary Items

All the above arguments make one key assumption that appears trivial, however really must be challenged rather more carefully: that the basic unit of the system is the pc. Every node has the motivation to mine on the block with the best rating and never observe some deviant technique. If the server will get hacked in a multisig then your pc and your backup nonetheless have 2 out of three keys, so you might be nonetheless secure. The issue with the method is that it implicitly assumes that customers have full management over their computer systems, and that the customers absolutely perceive cryptography and are manually verifying the Merkle tree branches. In actuality, this isn’t the case; in actual fact, the very necessity of multisig in any incarnation in any respect is proof of this, because it acknowledges that customers’ computer systems can get hacked – a duplicate of the behavioral-economics concept that people could be seen as not being in full management of themselves.

A extra correct mannequin is to view a node as a mix of two classes of brokers: a person, and a number of software program suppliers. Customers in almost all instances don’t confirm their software program; even in my very own case, though I confirm each transaction that comes out of the Ethereum exodus handle, utilizing the pybitcointools toolkit that I wrote from scratch myself (others have supplied patches, however even these I reviewed personally), I’m nonetheless trusting that (1) the implementations of Python and Ubuntu that I downloaded are official, and (2) that the {hardware} is just not someway bugged. Therefore, these software program suppliers needs to be handled as separate entities, and their objectives and incentives needs to be analyzed as actors in their very own proper. In the meantime, customers must also be seen as brokers, however as brokers who’ve restricted technical functionality, and whose selection set typically merely consists of which software program packages to put in, and never exactly which protocol guidelines to observe.

The primary, and most essential, statement is that the ideas of “Byzantine fault tolerance” and “single level of failure” needs to be seen in gentle of such a distinction. In concept, multisig removes all single factors of failure from the cryptographic token administration course of. In observe, nonetheless, that’s not the best way that multisig is normally introduced. Proper now, most mainstream multisig wallets are internet purposes, and the entity offering the online software is identical entity that manages the backup signing key. What this implies is that, if the pockets supplier does get hacked or does become evil, they really have management over two out of three keys – they have already got the primary one, and might simply seize the second just by making a small change to the client-side browser software they ship to you each time you load the webpage.

In multisig pockets suppliers’ protection, companies like BitGo and GreenAddress do supply an API, permitting builders to make use of their key administration performance with out their interface in order that the 2 suppliers could be separate entities. Nonetheless, the significance of this type of separation is at the moment drastically underemphasized.

This perception applies equally nicely to provably honest playing and proof of solvency. Specific, such provably honest protocols ought to have normal implementations, with open-source purposes that may confirm proofs in a typical format and in a means that’s simple to make use of. Companies like exchanges ought to then observe these protocols, and ship proofs which could be verifies by these exterior instruments. If a service releases a proof that may solely be verified by its personal inner instruments, that’s not significantly better than no proof in any respect – barely higher, since there’s a likelihood that dishonest will nonetheless be detected, however not by a lot.

Software program, Customers and Protocols

If we really do have two lessons of entities, will probably be useful to supply no less than a tough mannequin of their incentives, in order that we could higher perceive how they’re more likely to act. Typically, from software program suppliers we are able to roughly count on the next objectives:

- Maximize revenue – within the heyday of proprietary software program licensing, this aim was really simple to know: software program firms maximize their earnings by having as many customers as potential. The drive towards open-source and free-to-use software program extra lately has very many benefits, however one drawback is that it now makes the profit-maximization evaluation rather more tough. Now, software program firms typically become profitable via business value-adds, the defensibility of which generally includes creating proprietary walled-garden ecosystems. Even nonetheless, nonetheless, making one’s software program as helpful as potential normally helps, no less than when it does not intrude with a proprietary value-add.

- Altruism – altruists write software program to assist individuals, or to assist understand some imaginative and prescient of the world.

- Maximize popularity – today, writing open-source software program is usually used as a means of build up one’s resume, in order to (1) seem extra engaging to employers and (2) acquire the social connections to maximise potential future alternatives. Firms may do that, writing free instruments to drive individuals to their web site with a purpose to promote different instruments.

- Laziness – software program suppliers won’t write code in the event that they can assist it. The principle consequence of this might be an underinvestment in options that don’t profit their customers, however profit the ecosystem – like responding to requests for knowledge – except the software program ecosystem is an oligopoly.

- Not going to jail – this entails compliance with legal guidelines, which generally includes anti-features resembling requiring identification verification, however the dominant impact of this motive is a disincentive in opposition to screwing one’s prospects over too blatantly (eg. stealing their funds).

Customers we won’t analyze by way of objectives however quite by way of a behavioral mannequin: customers choose software program packages from an out there set, obtain the software program, and select choices from inside that software program. Guiding elements in software program choice embody:

- Performance – what’s the utility (that is the economics jargon “utility”) can they derive from the choices that the software program supplies?

- Ease of use – of explicit significance is the query of how rapidly they will rise up and working doing what they should do.

- Perceived legitimacy – customers usually tend to obtain software program from reliable or no less than trustworthy-seeming entities.

- Salience – if a software program bundle is talked about extra typically, customers might be extra more likely to go for it. An instantaneous consequence is that the “official” model of a software program bundle has a big benefit over any forks.

- Ethical and ideological concerns – customers may favor open supply software program for its personal sake, reject purely parasitic forks, and so on.

As soon as customers obtain a bit of software program, the principle bias that we are able to depend on is that customers will persist with defaults even when it won’t profit them to; past that, we’ve got extra conventional biases resembling loss aversion, which we’ll focus on briefly later.

Now, allow us to present an instance of how this course of works in motion: BitTorrent. Within the BitTorrent protocol, customers can obtain recordsdata from one another a packet at a time in a decentralized trend, however to ensure that one person to obtain a file there have to be somebody importing (“seeding”) it – and that exercise is just not incentivized. In truth, it carries non-negligible prices: bandwidth consumption, CPU useful resource consumption, copyright-related authorized danger (together with danger of getting one’s web connection shut down by one’s ISP, or maybe even a risk of lawsuit). And but individuals nonetheless seed – vastly insufficiently, however they do.

Why? The state of affairs is defined completely by the two-layer mannequin: software program suppliers need to make their software program extra helpful, so that they embody the seeding performance by default, and customers are too lazy to show it off (and a few customers are intentionally altruistic, although the order-of-magnitude mismatch between willingness to torrent copyrighted content material and willingness to donate to artists does counsel that the majority individuals do not actually care). Message-sending in Bitcoin (ie. to knowledge requests like getblockheader and getrawtransaction) can be altruistic but in addition equally explainable, as is the inconsistency between transaction charges and what the economics counsel transaction charges at the moment needs to be.

One other instance is proof of stake algorithms. Proof of stake algorithms have the (largely) frequent vulnerability that there’s “nothing at stake” – that’s to say, that the default conduct within the occasion of a fork is to attempt to vote on all chains, so an attacker want solely overpower all altruists that vote on one chain solely, and never all altruists plus all rational actors as within the case of proof of labor. Right here, as soon as once more we are able to see that this doesn’t imply that proof of stake is totally damaged. If the stake is basically managed by a smaller variety of refined events, then these events could have their possession within the forex as the motivation to not take part in forks, and if the stake is managed by very many extra unusual individuals then there would should be some intentionally evil software program supplier who would take an effort to incorporate a multi-voting characteristic, and promote it in order that doubtlessly customers really know in regards to the characteristic.

Nonetheless, if the stake is held in custodial wallets (eg. Coinbase, Xapo, and so on) which don’t legally personal the cash, however are specialised skilled entities, then this argument breaks down: they’ve the technical skill to multi-vote, and low incentive to not, notably if their companies will not be “Bitcoin-centric” (or Ethereum-centric, or Ripple-cetric) and assist many protocols. There may be even a probabilistic multi-voting technique which such custodial entities can use to get 99% of the advantages of multi-voting with out the danger of getting caught. Therefore, efficient proof of stake to a average extent is determined by applied sciences that enable customers to soundly preserve management of their very own cash.

Darker Penalties

What we get out of the default impact is actually a sure degree of centralization, having a useful function by setting customers’ default conduct towards a socially useful motion and thereby correcting for what would in any other case be a market failure. Now, if software program introduces some advantages of centralization, we are able to additionally count on a few of the damaging results of centralization as nicely. One explicit instance is fragility. Theoretically, Bitcoin mining is an M-of-N protocol the place N is within the 1000’s; if you happen to do the combinatoric math, the likelihood that even 5% of the nodes will deviate from the protocol is infinitesimally small, so Bitcoin ought to have just about good reliability. In actuality, after all, that is incorrect; Bitcoin has had a minimum of two outages within the final six years.

For many who don’t bear in mind, the 2 instances had been as follows:

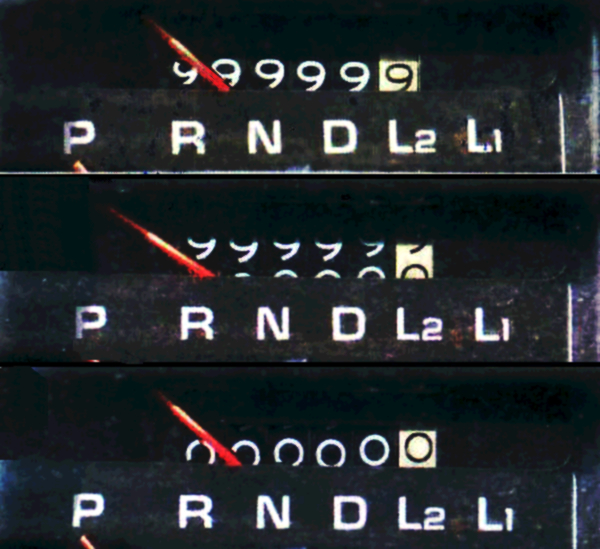

Driver of 43-year-old automobile exploits integer overflow vulnerability, sells it for 91% of unique buy worth passing it off as new

- In 2010, an unknown person created a transaction with two outputs, every containing barely greater than 263 satoshis. The 2 outputs mixed had been barely over 264, and integer overflow led to the entire wrapping round to near-zero, inflicting the Bitcoin shopper to suppose that the transaction really launched solely the identical small amount of BTC that it consumed as an enter, and so was official. The bug was fastened, and the blockchain reverted, after 9 hours.

- In 2013, a brand new model of the Bitcoin shopper unknowingly fastened a bug during which a block that remodeled 5000 accesses to a sure database useful resource would trigger a BerkeleyDB error, resulting in the shopper rejecting the block. Such a block quickly appeared, and new shoppers accepted it and outdated shoppers rejected it, resulting in a fork. The fork was fastened in six hours, however within the meantime $10000 of BTC was stolen from a fee service supplier in a double-spend assault.

In each instances, the community was solely in a position to fail as a result of, though there have been 1000’s of nodes, there was just one software program implementation working all of them – maybe the last word fragility in a community that’s typically touted for being antifragile. Different implementations resembling btcd at the moment are more and more getting used, however will probably be years earlier than Bitcoin Core’s monopoly is something near damaged; and even then fragility will nonetheless be pretty excessive.

Endowment results and Defaults

An essential set of biases to remember on the person aspect are the ideas of the endowment impact, loss aversion, and the default impact. The three typically go hand in hand, however are considerably totally different from one another. The default impact is mostly most precisely modeled as an inclination to proceed following one’s present technique except there’s a substantial profit to switching – in essence, a synthetic psychological switching value of some value ε. The endowment impact is the tendency to see issues as being extra helpful if one already has them, and loss aversion is the tendency to care extra about avoiding losses than looking for beneficial properties – experimentally, the scaling issue appears to be constantly round 2x.

The implications of those results pronounce themselves most strongly within the context of multi-currency environments. As one instance, think about the case of workers being paid in BTC. We will see that when persons are paid in BTC, they’re much extra more likely to maintain on to these BTC than they’d have been possible to purchase the BTC had they been paid USD; the reason being partially the default impact, and partially the truth that if somebody is paid in BTC they “suppose in BTC” so in the event that they promote to USD then if the worth of BTC goes up after that they’ve a danger of struggling a loss, whereas if somebody is paid in USD it’s the USD-value of their BTC that they’re extra involved with. This is applicable additionally to smaller token methods; if you happen to pay somebody in Zetacoin, they’re more likely to money out into BTC or another coin, however the likelihood is way lower than 100%.

The loss aversion and default results are a few of the strongest arguments in favor of the thesis {that a} extremely polycentric forex system is more likely to proceed to outlive, contra Daniel Krawisz’s viewpoint that BTC is the one token to rule them all. There may be clearly an incentive for software program builders to create their very own coin even when the protocol might work simply as nicely on prime of an present forex: you are able to do a token sale. StorJ is the most recent instance of this. Nonetheless, as Daniel Krawisz argues, one might merely fork such an “app-coin” and launch a model on prime of Bitcoin, which might theoretically be superior as a result of Bitcoin is a extra liquid asset to retailer one’s funds in. The explanation why such an consequence has a big likelihood of not taking place is solely the truth that customers observe defaults, and by default customers will use StorJ with StorJcoin since that’s what the shopper will promote, and the unique StorJ shopper and web site and ecosystem is the one that may get all the eye.

Now, this argument breaks down considerably in a single case: if the fork is itself backed by a robust entity. The most recent instance of that is the case of Ripple and Stellar; though Stellar is a fork of Ripple, it’s backed by a big firm, Stripe, so the truth that the unique model of a software program bundle has the benefit of a lot higher salience doesn’t apply fairly as strongly. In such instances, we don’t actually know what is going to occur; maybe, as is usually the case within the social sciences, we’ll merely have to attend for empirical proof to search out out.

The Manner Ahead

Counting on particular psychological options of people in cryptographic protocol design is a harmful recreation. The explanation why it’s good in economics to maintain one’s mannequin easy, and in cryptoeconomics much more so, is that even when needs like the need to amass extra forex models don’t precisely describe the entire of human motivation, they describe an evidently very highly effective part of it, and a few could argue the one highly effective part we are able to depend on. Sooner or later, training could start to intentionally assault what we all know as psychological irregularities (in actual fact, it already does), altering tradition could result in altering morals and beliefs, and notably on this case the brokers we’re coping with are “fyborgs” – useful cyborgs, or people who’ve all of their actions mediated by machines just like the one which sits between them and the web.

Nonetheless, there are particular basic options of this mannequin – the idea of cryptoeconomic methods as two-layer methods that includes software program and customers as brokers, the desire for simplicity, and so on, that maybe could be counted on, and on the very least we should always attempt to concentrate on circumstances the place our protocol is safe underneath the BAR mannequin, however insecure underneath the mannequin the place just a few centralized events are in observe mediating everybody’s entry to the system. The mannequin additionally highlights the significance of “software program politics” – having an understanding of the pressures that drive software program improvement, and trying to give you approaches to improvement that software program builders have the very best incentives (or, finally, write software program that’s most favorable to the protocol’s profitable execution). These are issues that Bitcoin has not solved, and that Ethereum has not solved; maybe some future system will do no less than considerably higher.

[ad_2]

Source link