[ad_1]

The largest cryptocurrency on this planet, Bitcoin is dropping its maintain on market supremacy, due to this fact altering the crypto scene. Analysts consider cryptocurrencies could quickly take the highlight as their market share drops to 55.80% and a confirmed promote sign flashes for the primary time since 2020. As Bitcoin’s price battles to maintain its momentum and falls beneath necessary trendline help, this sentiment picks traction.

Associated Studying

Bearish Alerts Set off Altseason Conjecture

The relative energy index (RSI) indicating Bitcoin’s dominance is buying and selling beneath its midline, due to this fact reinforcing detrimental expectations. Such conditions have traditionally cleared the trail for what is named “altseason”—a time when different cryptocurrencies shine above Bitcoin. Specialists contend that capital from Bitcoin may transfer into altcoins, producing instability and recent investing prospects.

The promote sign has simply flashed on the Bitcoin dominance for the primary time since 2020

Let the actual enjoyable of #ALTSEASON begins pic.twitter.com/R9QeCO69YH

— Mikybull 🐂Crypto (@MikybullCrypto) December 3, 2024

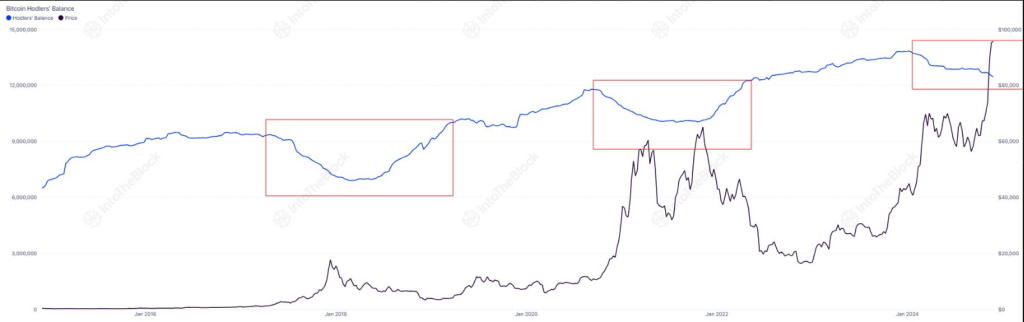

This development corresponds with the lowered holdings amongst long-term Bitcoin traders, therefore it’s not solely theoretical. Current knowledge from IntoTheBlock exhibits that wallets containing Bitcoin for greater than 155 days at the moment solely possess about 12.45 million BTC, the bottom quantity since mid-2022. These balances, declining nearly 10%, level to some people cashing in positive factors or shifting their cash to chilly wallets.

Bitcoin: Decline In Lengthy-Time period Holdings

Because the anticipated $100,000 aim for the alpha coin will get nearer, Bitcoin’s value has run into robust resistance. A number of failures at $97,500 have led to large drops. Bitcoin fell much more on Tuesday, promoting round $93,940. This volatility is matched by a transparent drop in long-term property, which makes it arduous to inform the place the market goes.

Bitcoin long-term holders are step by step decreasing their balances, now holding 12.45 million BTC—the bottom stage since July 2022.

Up to now, this decline is much less extreme than in previous cycles. Lengthy-term holder balances have fallen by 9.8% this cycle, in comparison with 15% in 2021 and 26% in… pic.twitter.com/eA5Cckrgs4

— IntoTheBlock (@intotheblock) December 3, 2024

Though the current drop in holdings is much less vital than these in 2021 or 2017, it attracts consideration to shifting market angle. Some observers say this conduct exhibits purposeful repositioning by skilled traders attempting to suit altering market circumstances.

Uncommon Bullish Sign Supplies Hope Amongst Bearish Temper

Even with the detrimental undertones, a uncommon bullish indication provides some hope. Not too long ago consistent with transferring averages, the Spent Output Revenue Ratio (SOPR) signifies that Bitcoin would possibly rally within the subsequent one to 2 months. Such indicators are uncommon, solely a few times throughout an upward market cycle.

Associated Studying

Though the bearish strain continues to be evident, consultants word that these constructive alerts present risk-tolerant traders some good prospects. In keeping with previous patterns following halving occasions, market observers are additionally getting ready for a potential droop as January 2025 attracts close to.

For now, the declining dominance and growing volatility of Bitcoin spotlight the necessity of a cautious but strategic method. Whether or not it’s Altseason or a recent Bitcoin surge, the following months may change the scene of cryptocurrencies.

Featured picture from DALL-E, chart from TradingView

[ad_2]

Source link