[ad_1]

Balanced on the sting of a head and shoulders sample, Bitcoin ($BTC) is seeing a brutal re-test of decrease help on its march past $100k and past.

Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

is boxed in, with help and resistance grinding nearer after weeks of volatility. The subsequent transfer isn’t simply essential—it’s all the things. Will it surge or collapse?

Key Assist and Resistance Ranges for Bitcoin Value

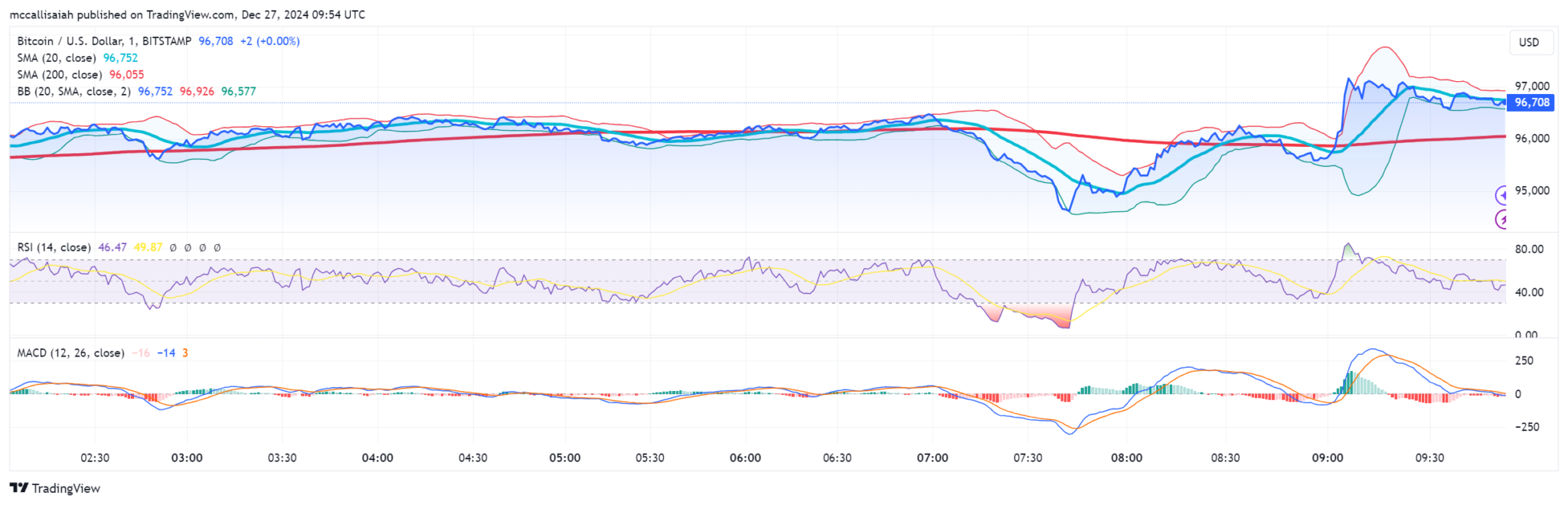

Bitcoin’s worth rests on two important factors. The $96,000 help zone, tied tightly to the 200-day Easy Shifting Common, acts as a stable basis for bullish momentum.

Repeatedly examined throughout downturns, it’s the road bulls can’t afford to lose.

Martin Shkreli @MartinShkreli is brief $MSTR.

Says:

– Saylor is insane

– no means this may finish properly

– Saylor is just not a superb advocate for #Bitcoin

– being quick MSTR has been painful

– he's bearish on bitcoin

Welcome Martin. Have enjoyable getting run over by Saylor and btc. pic.twitter.com/D0duGoGAG5— Flying Raven

(@OffshoreHODL) December 15, 2024

Bitcoin’s resistance is looming at $97,000, held agency by the higher Bollinger Band and up to date worth strikes. Cracking this ceiling may simply spark a bigger rally to unfold.

Whereas there isn’t a present golden cross seen (the place a shorter shifting common crosses above an extended one), the SMA alignment suggests the chance brewing in the coming weeks, which might sometimes signify bullish momentum.

Bitcoin’s Bollinger Bands are stretching wider, an indication of rising market turbulence. 99Bitcoin’s analysts have our eyes on quantity spikes to see in the event that they’ll push the worth by means of these defining traces.

EXPLORE: 11 Best AI Crypto Coins to Invest in 2024

BTC Chart Patterns and What to Watch For Bitcoin in 2025

Different figures price eyeing may tip the scales on whether or not BTC breaks out or spirals down:

- RSI (Relative Power Index): Sitting at 46.47, the RSI signifies Bitcoin is neither overbought nor oversold.

- MACD (Shifting Common Convergence Divergence): Momentum is neutralizing, with the MACD line converging towards the sign line. The flattening histogram suggests diminished momentum for now, however this might change rapidly with new market catalysts.

Moreover, some analysts are intently monitoring a attainable head-and-shoulders sample. If confirmed, this might sign a short-term reversal with a pullback to as little as $80,000—a broadly speculated goal for a mid-bull market correction.

A transfer previous $97,000 cements the bullish continuation, clearing the best way for increased resistance ranges to emerge.

However drop beneath $96,000, and the bears take the reins, setting sights on $93,000 and even the $90,000 line briefly order.

EXPLORE: Biggest Meme Coin Of 2024! The Year’s Biggest Winners In Review

Crypto Market Sentiment and Whales’ Exercise

Regardless of the present consolidation, market sentiment seems cautiously optimistic. Analysis agency Santiment famous a current inflow of stablecoins into exchanges, usually interpreted as whales making ready for purchasing alternatives.

Bitcoin’s chart for 2025 alerts a drawn-out consolidation part, holding its breath for the following massive transfer.

The $96,000 help and $97,000 resistance are the important thing battle traces, with buying and selling quantity more likely to determine the winner. Will resistance crack, reigniting its six-figure ambitions, or does the market tilt towards one other nosedive? The reply lies in what comes subsequent.

EXPLORE: Ukraine deems Bitcoin illegal, Coinbase fights for new $50 million founding round and more

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit Bitcoin ‘Head and Shoulders’ Pattern Sparks $80K Price Dip Warning appeared first on 99Bitcoins.

[ad_2]

Source link