[ad_1]

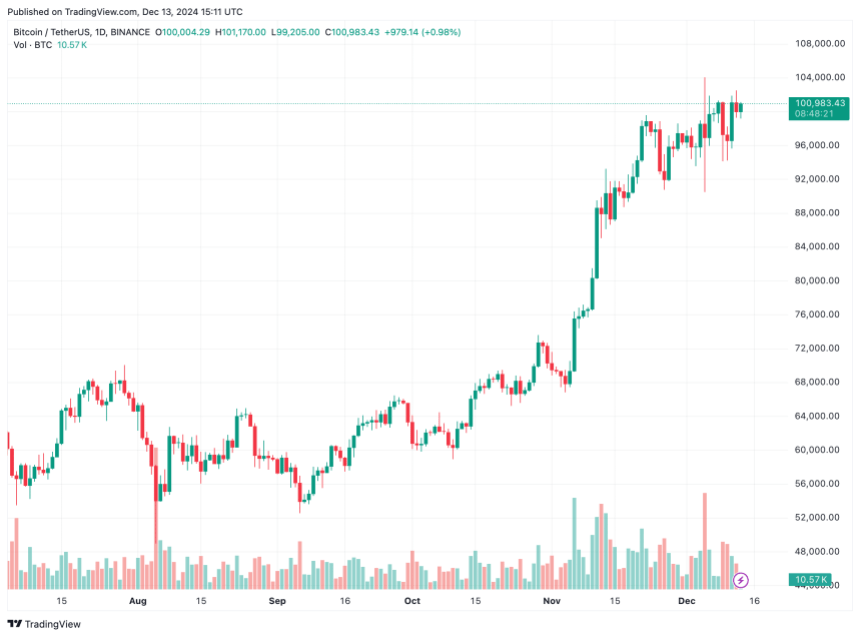

Whereas Bitcoin (BTC) fluctuates across the essential $100,000 value degree, some buyers could search the perfect alternative to take income and exit the market. On this context, a CryptoQuant evaluation highlights a key BTC metric that may function a helpful software for crafting an exit technique.

Have Income In Bitcoin? Hold An Eye On This Indicator

In a Quicktake weblog put up printed immediately, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC through the present bull market. The analyst emphasised the significance of the Bitcoin provide in loss metric, noting its potential to sign when to begin exiting the market to protect income.

Associated Studying

For these unfamiliar with Bitcoin, the provision in loss measures the proportion of BTC held at a loss based mostly on its final moved value. A low proportion of provide in loss sometimes signifies peak market euphoria and serves as a warning to safe income earlier than a bear market correction begins.

In line with the CryptoQuant evaluation, when BTC provide in loss drops beneath 4%, it alerts an excellent time for buyers to contemplate dollar-cost averaging (DCA) out of their BTC holdings and look ahead to the subsequent bear market lows. At present, the BTC provide in loss sits at 8.14%.

DCA is an funding technique the place buyers allocate a set sum of money to an asset at common intervals, no matter its value. This methodology helps scale back the impression of market volatility and lowers the common value per unit over time. The analyst provides:

Why? Beneath 4% means lots of people are in a revenue that is the height bullrun part. Belief me you don’t wish to be bagholding since you thought we’ll by no means see a bear market once more. Be fearful when others are grasping.

Analysts Assured Of Additional Upside In BTC Value

Whereas monitoring the BTC provide in loss metric can assist buyers safeguard their income, current forecasts from crypto analysts counsel there would possibly nonetheless be room for additional upside earlier than this indicator turns into essential.

Associated Studying

In line with crypto analyst Ali Martinez, BTC forms a basic cup and deal with sample on the weekly chart. The premier cryptocurrency seems to be poised to interrupt out of the bullish formation, with targets as excessive as $275,000.

Equally, Donald Trump’s victory has introduced contemporary optimism within the crypto business. Within the lately concluded Bitcoin MENA convention in Abu Dhabi, Trump’s former marketing campaign chairman, Paul Manafort, noted that BTC buyers can “anticipate greater than $100,000” through the ongoing market cycle.

Different forecasts stay equally bullish. Tom Dunleavy, Chief Funding Officer at MV World, projects BTC to succeed in $250,000, whereas Ethereum (ETH) would possibly climb to $12,000 throughout this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% up to now 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant and TradingView.com

[ad_2]

Source link