With the Bitcoin value caught within the mid-$90,000s and the market bracing for a flood of financial updates, Wall Street is already celebrating.

The S&P 500 and Dow Jones broke new floor, ignoring the same old nervousness traps of commerce disputes and faltering economies. To not be outdone, the Nasdaq 100 rallied on tech and client wins, whereas utilities—the market’s darkish horse—silently overshot forecasts and left analysts blinking.

Key Financial Occasions to Watch As Bitcoin Worth Crabs

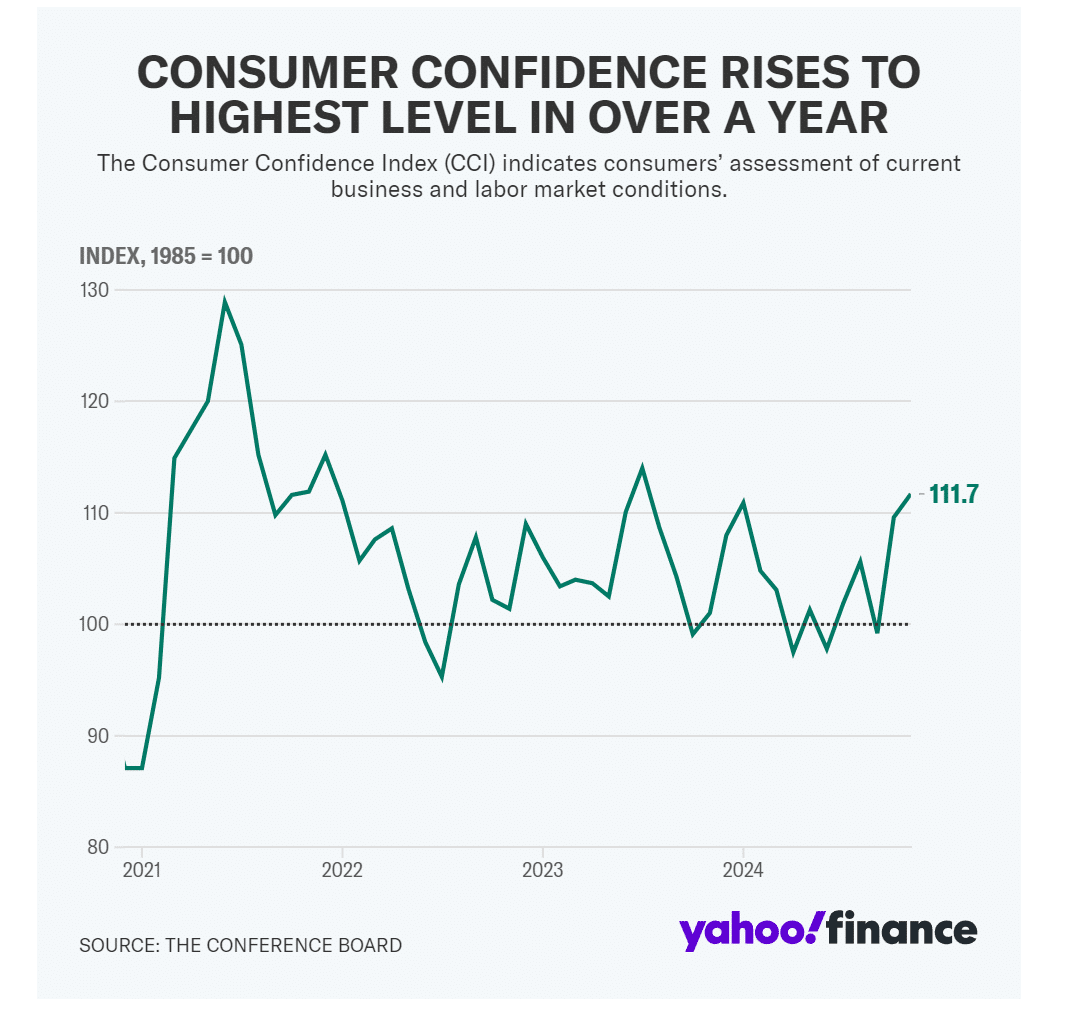

The U.S. financial calendar is stacked this week, and it’s all in regards to the numbers that would twist market sentiment. U.S. client knowledge kicked off the motion with Tuesday bringing updates on client confidence, new dwelling gross sales, and the Richmond Manufacturing Index—a fast pulse examine on spending habits and financial momentum.

By midweek, the main focus shifts overseas with Australia’s inflation stats and the RBNZ’s coverage transfer.

Again within the U.S., a torrent of stories will drop—GDP projections, sturdy items knowledge, and the coveted core PCE value index—all capped with the FOMC assembly minutes.

The latest FOMC indicated that the Federal Reserve may pause rate of interest cuts if inflation doesn’t decelerate.

EXPLORE: 20 Next Cryptocurrencies to Explode in 2024

Document Highs Amid Combined World Indicators

Despite the fact that US shares are pumping the remainder of the world is hurting. This week, New Zealand’s central financial institution takes the highlight with a 50-basis-point price lower on deck, bringing coverage charges to 4.25%.

Inflation may be shedding steam there, however unemployment’s tick as much as 4.8% alerts an economic system softening on the edges. Throughout the map, Japan’s inflation story unfolds Friday with a predicted 2% pop in Tokyo’s Core CPI, setting the tone for additional shifts nationally.

India to overhaul Japan and turn into the world’s 4th largest economic system subsequent yr. pic.twitter.com/VzLdPThLAo

— Globe Eye Information (@GlobeEyeNews) November 18, 2024

Over within the eurozone, inflation knowledge exhibits a projected 2.8% for core charges, retaining merchants locked onto ECB alerts.

BTC ETFs Are Seeing Large Outflows

Boomers will at all times Boomer, and they’re taking out their 1.2X on the Bitcoin ETFs.

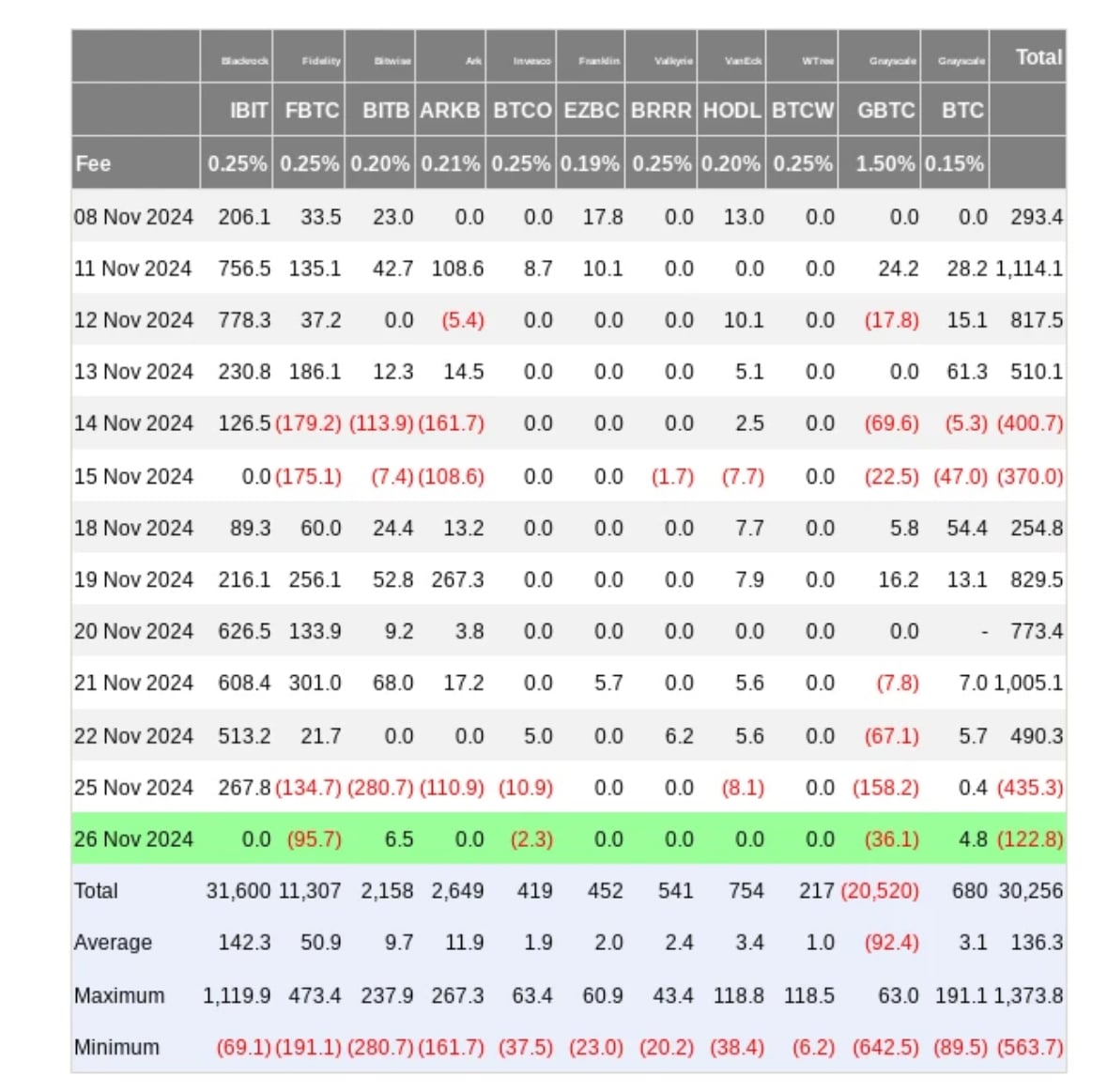

Though Bitcoin ETFs have turn into the best-performing ETFs in historical past, Monday hit the Bitcoin ETF market like a intestine punch, with $438 million bleeding out. This ended a five-day streak that funneled in $3.4 billion. Bitcoin’s transient dalliance with $100,000 crumbled as its value slid to $94,515, a 3.55% loss in simply 24 hours.

It’s over. The highest is in. Bitwise’s BITB felt the brunt of it, dumping $280 million, adopted by Grayscale’s GBTC shedding $158.2 million. Constancy’s FBTC dropped $134.7 million, and Ark’s ARKB bled out one other $110.9 million. Nonetheless, BlackRock’s IBIT stood tall, raking in a cool $267.8 million, retaining some optimism afloat.

99Bitcoins analysts consider these ETF traders are rebalancing, as we noticed an analogous outflow round Nov. 14-15 after a brand new ATH.

EXPLORE: Crypto Crash Sends Shockwaves Through Market: Why Is Bitcoin Down and Is the Bull Run Over?

Lastly, Might Michael Saylor Crash the Bitcoin Worth?

One final occasion making its manner across the horn is Michael Saylor is wanting like this season’s foremost character, and you already know what occurs to foremost characters in crypto.

The MicroStrategy founder is drastically rising his common in Bitcoin. Some speculate that if the BTC value collapses, this would be the next FTX.

Saylor is betting the farm on Bitcoin, and historical past doesn’t repeat, nevertheless it typically rhymes.

Right here’s how the story goes: In 2000, MicroStrategy was a rising star in knowledge analytics. The inventory went parabolic, and CEO Michael Saylor turned a billionaire in a single day. Then… actuality examine. They introduced income restatements. Buyers noticed the rip-off, and the inventory crashed over 99%.

It’s one of many biggest busts of the dot-com period.

Quick ahead 20 years. MicroStrategy’s nonetheless round, however low-key. Then Saylor will get a brand new obsession: Bitcoin. He begins stacking BTC like his life relies on it. Company treasury? Converts it to Bitcoin. Takes out loans? Buys Bitcoin. Does it promote extra inventory? You guessed it: Bitcoin.

BTC hits $69K, and he’s hailed as a genius.

We’ll pause for a second right here as a result of Saylor is an important figure within the Bitcoin group. He supported it when others known as it a rip-off.

However MacroStrategy’s inventory value doesn’t observe the enterprise; it tracks Bitcoin. Their stability sheet is now principally a leveraged BTC ETF. If BTC drops under its common purchase value, margin calls begin knocking.

Fortunately, and by a large margin, this goofy knowledge analytics firm is operating circles across the competitors with its BTC investing technique. Establishments like MicroStrategy purchase Bitcoin over the counter. The factor is, the OTC reserves are operating out of Bitcoin, and miners are not producing enough.

If issues proceed this manner, the squeeze previous $100k Bitcoin goes to be epic.

We’ll proceed to observe whether or not international macroeconomic occasions will assist Bitcoin or preserve it in value limbo.

EXPLORE: 20 New Crypto Coins to Invest in 2024

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The publish Could US Preliminary GDP Data Trigger Reversal in Bitcoin Price? appeared first on .