[ad_1]

Information exhibits the cryptocurrency derivatives market has suffered a excessive quantity of liquidations prior to now day as Bitcoin and different belongings have crashed.

Bitcoin, Ethereum Noticed Notable Plunges Throughout Previous Day

The final 24 hours have been red for digital belongings, with a bulk of the market observing a drawdown of greater than 5%. Bitcoin has been no exception, as its worth has slipped underneath the $95,000 stage.

It was solely a few days again that the asset had proven a sharp recovery above the $102,000 mark. The steep crash since then would recommend the buyers didn’t consider the rally would have legs, in order that they determined to take their income whereas they might.

Ethereum, the second largest cryptocurrency by market cap, has had it even worse than Bitcoin, with its worth coming right down to $3,350 after a drop of virtually 8% through the previous day.

With its plunge, Ethereum has principally retraced all of the bullish momentum that had include this new yr of 2025. Bitcoin nonetheless retains a few of its features, but when the present trajectory continues, it wouldn’t be lengthy earlier than it meets the identical destiny as nicely.

With all of the carnage that the digital asset sector has seen, it might be anticipated that the derivatives aspect of the market would likewise have gone via some chaos.

Crypto Longs Have Simply Taken A Huge Beating

In line with information from CoinGlass, a mass quantity of liquidations have piled up on derivatives exchanges through the previous day. “Liquidation” refers back to the forceful closure that any open contract undergoes after it has amassed losses of a sure diploma (the precise proportion of which can differ between platforms).

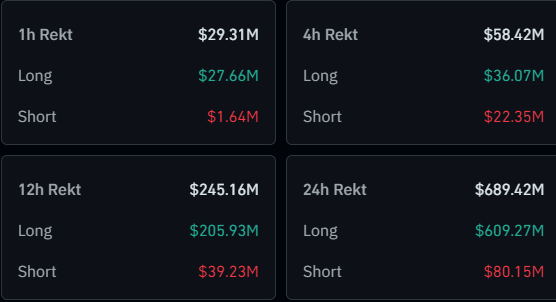

Under is a desk that breaks down the related numbers associated to the most recent cryptocurrency liquidations.

As is seen, a complete of $689 million in contracts have been flushed within the final 24 hours. Out of those, over $609 million of the positions concerned have been lengthy ones. This implies an awesome 88% of the liquidations affected the merchants betting on a bullish consequence for the market.

Given the crash that the cryptocurrency sector has gone via throughout this window, it’s not precisely a shock to see this disparity between lengthy and quick liquidations.

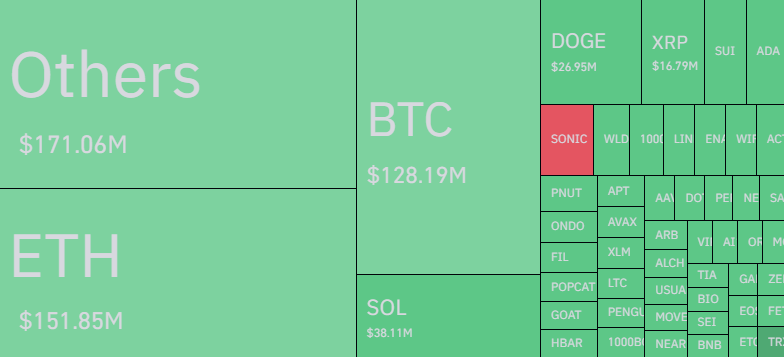

When it comes to the contributions to the squeeze by the person symbols, Bitcoin has curiously not topped the charts this time round. As a substitute, Ethereum has been king with virtually $152 million in liquidations.

The truth that Ethereum’s drawdown has been extra important than Bitcoin’s has half to play on this, however it might not be the total story. It’s doable that the development is a sign that the speculative curiosity round ETH has been notably pronounced lately.

[ad_2]

Source link