[ad_1]

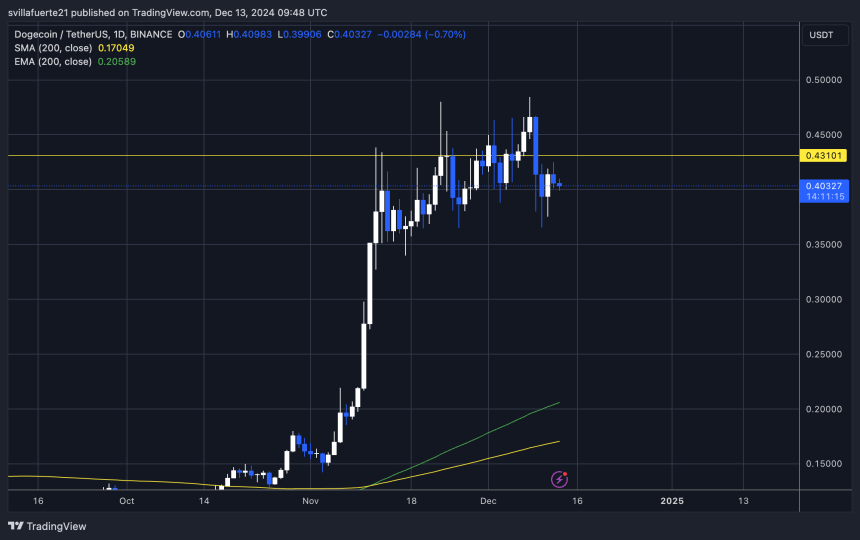

Dogecoin is testing demand above the $0.40 degree following a number of days of consolidation under its yearly excessive of $0.484. This era of uneven value motion has saved merchants on edge, as Dogecoin’s value seems poised for a decisive transfer. Regardless of the short-term pause in upward momentum, market sentiment stays optimistic, with many traders anticipating one other breakout.

Associated Studying

Prime analyst and dealer Hardy lately shared a technical evaluation highlighting Dogecoin’s potential for a large value surge. In response to Hardy, it’s solely a matter of time earlier than DOGE breaks into new all-time highs. His evaluation means that Dogecoin is constructing a robust basis, and continued consolidation at present ranges is a bullish sign.

If Dogecoin maintains support above $0.40, the stage might be set for a major rally within the coming weeks. Nonetheless, a lot will depend upon broader market situations and the flexibility of DOGE to maintain shopping for stress. All eyes are on its skill to beat resistance and resume its bullish development. With whale exercise and buying and selling volumes exhibiting indicators of development, Dogecoin might quickly retest its highs, ushering in a brand new chapter of value discovery.

Dogecoin Consolidates At Present Ranges

Dogecoin is consolidating under its yearly excessive of $0.484 after a powerful rally, and it seems this part of sideways motion could persist for a while. Whereas the value motion has calmed, investor sentiment stays notably optimistic, with many viewing this consolidation as a stepping stone towards even greater value ranges.

Prime analyst and dealer Hardy lately shared a detailed technical analysis on X, providing a bullish outlook for Dogecoin. In response to Hardy, DOGE’s present value motion is a wholesome consolidation inside a broader uptrend. He emphasised that the asset is constructing a stable base, which will increase the probability of a major breakout. Hardy’s projection means that Dogecoin is poised to surpass its yearly excessive and can also be on monitor to attain a brand new all-time excessive (ATH).

In his evaluation, Hardy highlighted key assist ranges round $0.40 and $0.36, indicating these areas as essential for sustaining the bullish construction. He additionally mapped out a possible value trajectory, predicting that Dogecoin will consolidate at present ranges for a number of weeks earlier than resuming its upward momentum. His optimistic goal for DOGE is $2, which he believes might be reached if the broader market stays favorable and shopping for stress intensifies.

Associated Studying

Whereas consolidation could check the persistence of merchants, Hardy’s evaluation aligns with the broader view that Dogecoin is making ready for one more main leg up. A brand new ATH might be simply across the nook so long as it holds key assist ranges and sentiment stays constructive.

DOGE Value Motion: Key Ranges To Watch

Dogecoin (DOGE) trades at $0.40 after a 24% retrace from its native highs. Regardless of this pullback, the value has exceeded this key demand degree, signaling resilience amongst bulls. Market members are carefully watching the $0.40 zone, representing a important level for figuring out the subsequent transfer in DOGE’s value motion.

If DOGE can reclaim the $0.43 degree within the coming days, it will probably set the stage for a retest of its yearly excessive at $0.484. A breakout above this resistance might reignite bullish momentum and pave the best way for additional upside, probably attracting renewed curiosity from merchants and traders. Nonetheless, sustaining assist and gaining traction is crucial for this state of affairs to unfold.

Associated Studying

On the flip facet, dropping the $0.40 degree might sign that bearish sentiment is gaining market management. On this case, DOGE would possibly face a deeper correction, with the subsequent important assist ranges probably rising close to $0.36. Such a transfer would problem the bullish outlook and delay DOGE’s efforts to achieve new highs.

Featured picture from Dall-E, chart from TradingView

[ad_2]

Source link