[ad_1]

Ethereum at present rests at a notable assist area close to $3.2K, with market contributors intently observing the potential for a bullish rebound.

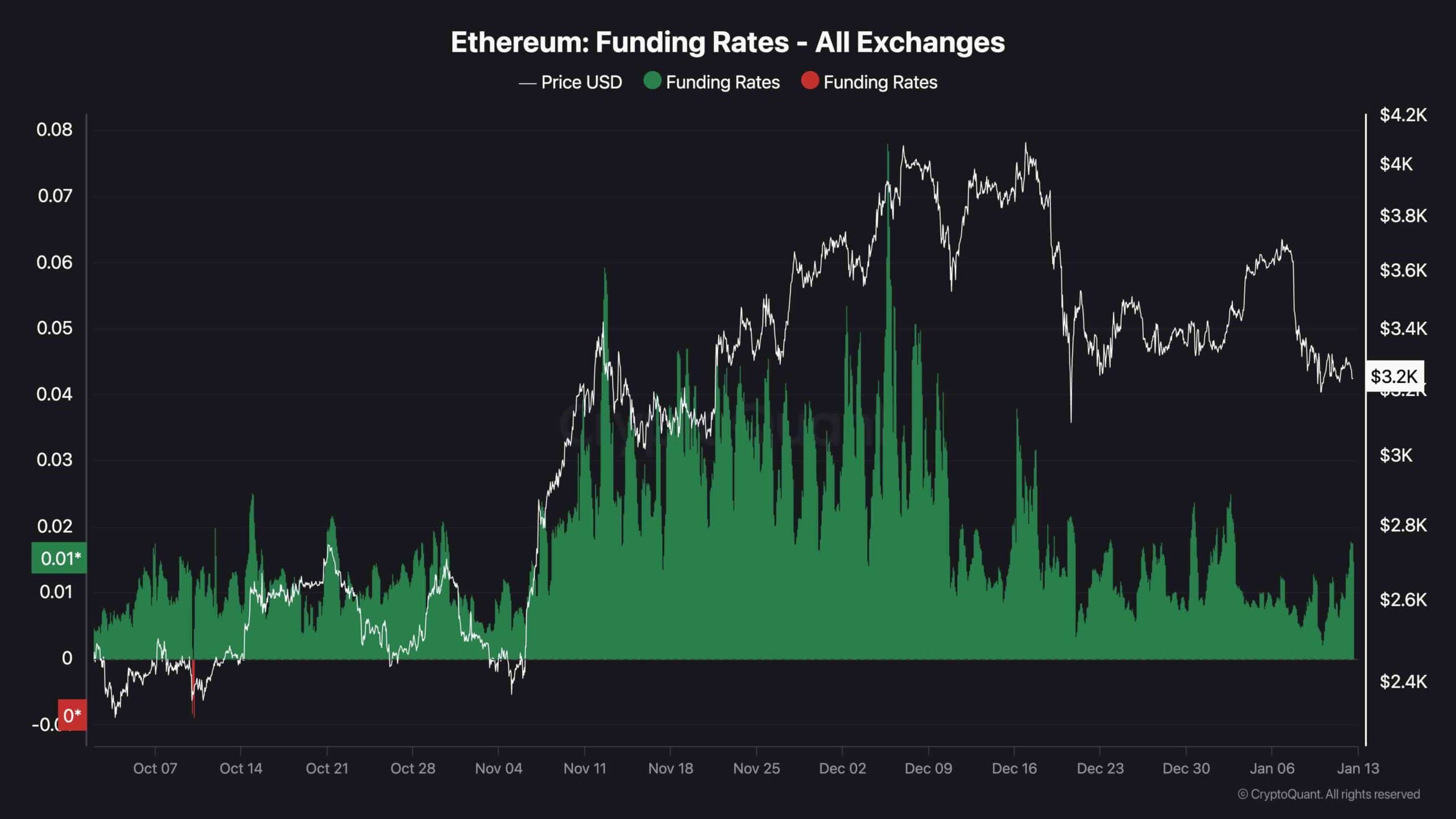

The Funding Charges metric gives beneficial insights into the sentiment inside the perpetual futures markets, serving to to gauge the probability of a restoration.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum has seen constant declines following its rejection on the $4K resistance stage, indicating the dominance of sellers. Most just lately, one other sharp decline pushed the worth towards a considerable assist zone, outlined by the 100-day transferring common of $3.1K.

This dynamic assist is vital as demand focus close to this area is predicted to curb downward momentum, with a bullish rebound being believable if shopping for curiosity emerges.

Presently, ETH is trapped between the 100-day MA ($3.1K) and the $3.5K resistance stage, forming a good consolidation vary. A decisive transfer in both route will possible decide the mid-term pattern.

The 4-Hour Chart

On the 4-hour timeframe, Ethereum broke down from an ascending wedge sample, a bearish construction that usually alerts additional declines. This breakdown triggered a swift sell-off, pushing the worth towards a assist zone outlined by the 0.5-0.618 Fibonacci retracement ranges.

This assist zone has the potential to stabilize the worth and probably provoke a short-term bullish rebound. Nevertheless, persistent bearish stress might end in a break beneath this line, intensifying the downtrend.

If Ethereum breaches this vital assist zone, it could set off panic promoting, additional strengthening sellers’ dominance. Conversely, a sustained rebound might pave the way in which for a restoration towards the $3.5K resistance stage.

Onchain Evaluation

By Shayan

Inspecting the chart, the current market correction has coincided with a big decline in funding charges. This shift suggests rising bearish sentiment amongst speculators, with many merchants betting on additional decreases in ETH’s value.

Nevertheless, upon reaching the substantial assist zone at $3K, the Funding Charges metric has began to point out indicators of restoration. A notable bullish spike within the metric suggests an inflow of shopping for curiosity as market contributors start to open lengthy positions in anticipation of a value rebound.

If this restoration in funding charges continues, it might point out sustained demand and the potential for a bullish rebound from the $3K assist. Alternatively, if the present restoration loses momentum or reverses, it will sign a return to bearish sentiment, paving the way in which for a deeper correction.

The put up Ethereum Price Analysis: What’s Ahead for ETH After a 9% Weekly Dip? appeared first on CryptoPotato.

[ad_2]

Source link