[ad_1]

Ethereum (ETH) is as soon as once more within the information, however this time it’s excellent news for patrons. Latest information exhibits that over 90% of Ethereum customers at the moment are being profitable as a result of the value of the cryptocurrency has risen to spectacular ranges. In keeping with IntoTheBlock, this upward development is the perfect time in 5 months for individuals who personal ETH to make income.

Impressed by Bitcoin’s comeback above $96,000, the token jumped to $3,680, its largest stage since June. Whereas Bitcoin cleared the trail, Ethereum’s momentum is clearly seen because it broke obstacles with ease. Although buying and selling 25% under its all-time excessive (ATH) of $4,890, Ethereum’s fundamentals and market vibe level to a vibrant future forward.

90.8% of $ETH holders at the moment are in revenue, the very best since June.

Apparently, the 9.2% of holders nonetheless at a loss maintain simply 2.8% of the full provide. This means that potential promote stress from this group could have a restricted affect as $ETH continues to development upward. pic.twitter.com/qG4Xgi0Cq3

— IntoTheBlock (@intotheblock) November 28, 2024

Whale Confidence And Lengthy-Time period Holding

Extra optimistic information comes from nearer examination of the funding patterns of Ethereum. Solely 9.2% of ETH holders are at the moment dropping cash, and so they maintain solely 2.8% of your complete token depend. Because of this the market is unlikely to be a lot affected by any promoting stress these buyers create.

On high of that, Ethereum’s long-term holder base can be sturdy. The variety of ETH holders holding multiple yr has risen to roughly 74%, which signifies confidence within the token’s long-term worth. Contemplating that solely 23% of ETH have been bought final yr and solely 3% final month, many of the buyers appear to be holding out for the long term.

Lowering Provide, Bullish Momentum

One more reason giving a bullish outlook to Ethereum is the declining provide on centralized exchanges. In keeping with analysts, it has continued to say no since final yr, decreasing ETH on centralized reserves. The extra demand there’s that outpaces the provision throughout a bull run, the upper the costs go.

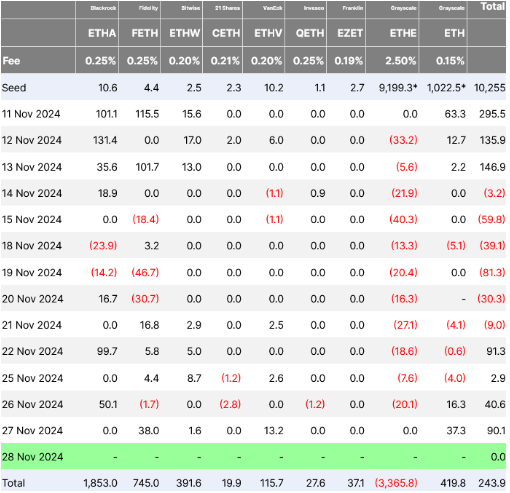

Ethereum’s latest surge has additionally been aided by big inflows into spot ETFs, which have over $90 million. These institutional investments show rising belief in Ethereum’s future.

Ethereum: Path To ATH Seems Clear

ETH is already outperforming the bigger crypto market, with a weekly acquire of 12%. Its ETH/BTC ratio has risen by 18%, indicating energy relative to Bitcoin. Analysts really feel that if Ethereum can retest and surpass the $4,000 resistance, the trail to its all-time excessive would change into extra convincing.

With 5.92% elevated values over the day gone by, its worth has decreased barely to $3,610, as of writing. From the indications and market’s sentiment, Ethereum tends to rewrite the earlier excessive to additional break floor.

Featured picture from DALL-E, chart from TradingView

[ad_2]

Source link