[ad_1]

South Korea has as soon as once more postponed the implementation of its 20% tax on cryptocurrency features, marking the third delay for the reason that tax was first proposed in 2021.

The most recent choice, announced on 1 December 2024, will push the tax implementation to 2025, following an settlement between the Democratic Occasion of Korea (DPK) and the ruling Individuals Energy Occasion (PPP) throughout finances negotiations.

Initially deliberate for 1 January 2022, the tax has confronted repeated postponements as a consequence of regulatory issues and political debates.

NEW:

South Korea delays its 20% tax on crypto-asset features by two extra years till 2025 pic.twitter.com/dmW9QwDxNr

— Blockworks (@Blockworks_) June 20, 2022

The DPK Ground Chief Park Chan-dae confirmed the delay at a press convention, emphasizing the necessity for extra institutional preparation earlier than implementing the tax.

“After in-depth discussions on the postponement of taxation on digital property, I assumed that now’s the time for extra institutional overhaul,” he said.

The proposed delay will probably be voted on throughout a plenary session of the Nationwide Meeting on 2 December.

Historical past Of Postponements Beginning 2021

The 20% tax on cryptocurrency features exceeding 2.5 million Korean gained ($1,784) was first proposed in 2021 to deal with the rising marketplace for digital property. Nevertheless, issues over market volatility and an absence of sturdy infrastructure led to its preliminary delay to 2023.

Subsequent political pressures and the necessity for regulatory refinement postponed the tax to 2025, and now additional to 2027.

Within the newest deliberations, the DPK argued for extra institutional preparation earlier than implementing the tax. “After deep dialogue, I assumed that the digital asset tax deferral was a time when extra institutional overhaul was crucial,” stated Park Chan-dae, the DPK ground chief, throughout a press briefing.

This sentiment was echoed by Ko Kwang-hyo, tax coverage chief on the Ministry of Economic system and Finance, who emphasised the necessity for extra complete market infrastructure earlier than implementing the tax.

The DPK had initially pushed for the next tax-deductible threshold of fifty million gained ($35,714) to alleviate the burden on smaller buyers.

Nevertheless, the newest choice aligns with the federal government and ruling celebration’s proposal for a two-year delay, favoring broader structural enhancements.

EXPLORE: South Korean Authorities Uncover $232M Crypto Fraud, YouTube Star In Spotlight

South Korean Merchants Drive XRP Surge

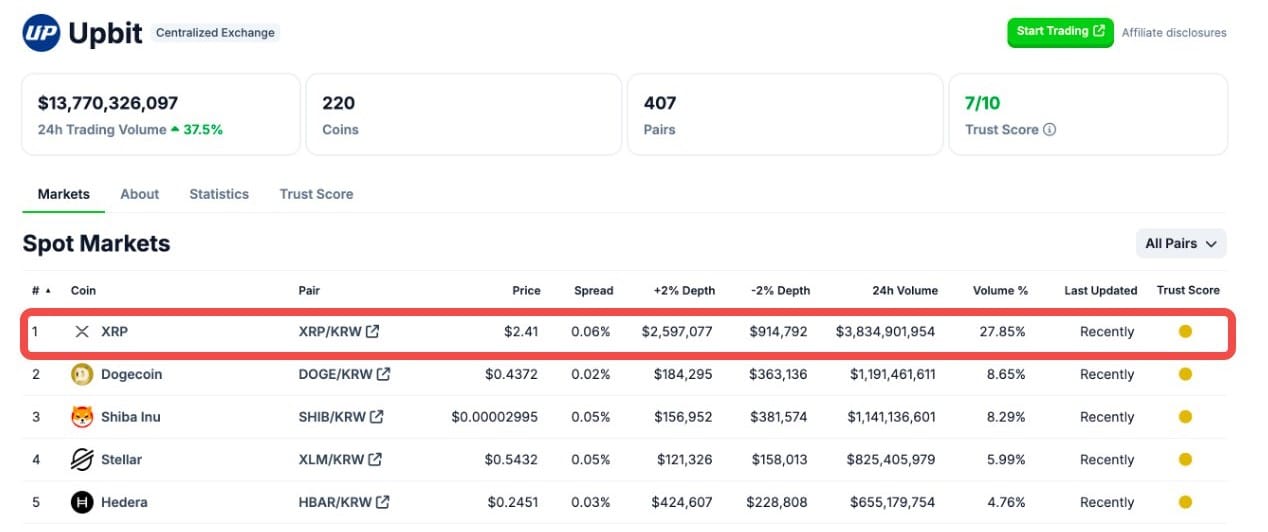

South Korea is residence to one of many world’s most lively retail cryptocurrency markets, with exchanges like Upbit rating among the many high 5 international spot exchanges. Upbit alone noticed over $11 billion in commerce quantity inside a 24-hour interval, highlighting the market’s sturdy exercise.

Blockchain analytics agency Scopescan reported that

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

/KRW buying and selling quantity on the South Korean alternate reached $3.8 billion within the final 24 hours—an quantity that outpaced Bitcoin trades by an astounding 11 occasions.

Equally, XRP exercise on Bithumb, one other main South Korean platform, hit $1.2 billion, accounting for 32% of the alternate’s complete buying and selling quantity.

Ryan Kim, co-founder of Hashed, attributed this loyalty to the nation’s early adoption of XRP, which started way back to 2014 by campaigns by Ripple Labs.

“Ripple Labs bought XRP to Korean Ajummas with a Ponzi scheme in 2014. It was known as ‘Ripple Market Korea.’ There have been so many individuals invested in XRP again then. Most likely they made a lot cash lol. There’s a real XRP neighborhood in Korea, and that’s why Koreans are shopping for XRP so much,” Kim stated.

EXPLORE: Is It Possible to Get Free Crypto CATS? Here’s The Best Way to Stack CATs in Q4

Political Dynamics And Public Backlash

The postponement highlights the political sensitivities surrounding the taxation of cryptocurrency features in South Korea, a nation with probably the most lively retail crypto markets globally.

Opposition events have criticized the tax as a “youth tax,” arguing that it disproportionately impacts youthful buyers who dominate the nation’s crypto market.

“Opinions inside the celebration differed till the top, so we didn’t attain an general settlement,” a management official stated. The PPP argued that the tax would stifle the monetary aspirations of younger buyers, a demographic crucial to the nation’s financial future.

Throughout the press convention, Park Chan-dae additionally addressed broader fiscal insurance policies, rejecting proposals to decrease the highest inheritance tax charge and separate taxation of dividend revenue. He described these measures as “tax cuts for the ultra-rich,” reiterating the celebration’s give attention to equitable taxation.

The postponement might aligns with broader efforts to control digital property, together with the Digital Property Fundamental Act, which is about to manipulate the issuance and itemizing of cryptocurrencies.

The publish South Korea Delays 20% Crypto Tax For Third Time, Cites Regulatory Refinement appeared first on .

[ad_2]

Source link