[ad_1]

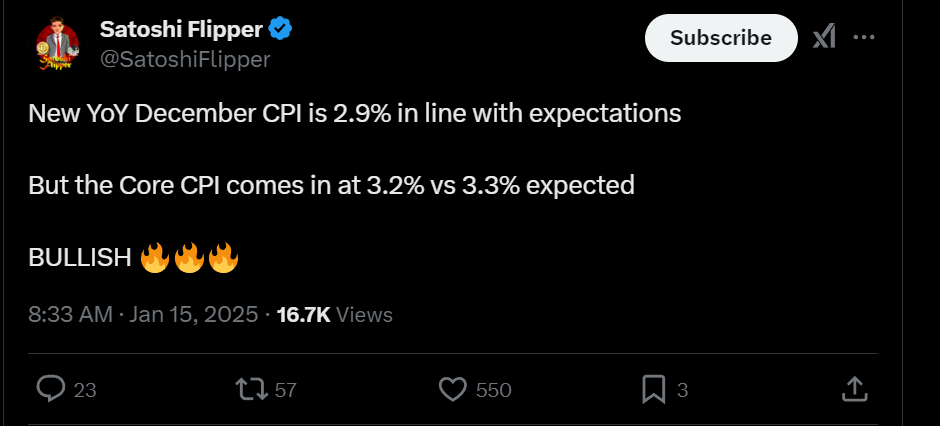

As we speak’s CPI report is in, and for the primary time since July 2024, inflation obtained rekt.

With December’s CPI showing signs of slowdown, inflation hawks are catching a uncommon glimpse of reduction. All eyes now flip to the Federal Reserve as this deceleration reshapes the financial chessboard.

The Client Value Index (CPI), which maps out worth modifications in city shopper items and providers, stays the go-to barometer for financial inflation.

Everybody can really feel that the Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Value

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

(BTC) worth motion is currently manipulated AF.

But, like clockwork, Bitcoin pumped 2% on the information, reclaiming $98,000. So the place does the Bitcoin worth head subsequent?

Core CPI Falls for the First Time in Months

This man wish to increase charges. And seeing as how job development was stronger than beforehand anticipated, markets had been betting that Fed Chair Jerome Powell wouldn’t entertain the thought of slicing rates of interest.

Now that choice is again on the desk, markets responded with a sigh of reduction.

Inventory futures ticked up, and the 10-year Treasury yield fell to below 4.7%, pushed by a slight increase in investor confidence. However the Fed’s battle isn’t over—prices for used automobiles and transportation stay stubbornly excessive, leaving inflation elevated and unpredictable.

Headline inflation ticked up 2.9% year-over-year in December, edging above November’s 2.7%. It climbed 0.4% month-to-month, with gas costs and stubbornly excessive meals prices doing a lot of the injury.

Vitality shot up 2.6%, fueled by a 4.4% spike in fuel costs, which made up 40% of the month’s CPI good points.

UK inflation additionally caught everybody off-guard in December, slipping to 2.5% from November’s 2.6%. That tiny drop—the primary in three months—has fueled discuss of an rate of interest lower on the horizon.

How Will CPI Affect on Federal Reserve Coverage?

The inflation report is a mixed bag for the Fed, pointing to gradual progress whereas exposing the grind of hitting its 2% objective.

Morgan Stanley’s Ellen Zentner dubbed the CPI information “dovish,” sufficient to maintain expectations agency for a pause in fee strikes this month, placing hawkish chatter on ice.

On the horizon, Donald Trump’s proposed tariffs and tax breaks might additional stoke inflation when his insurance policies take impact in 2025.

Optimism for 2025

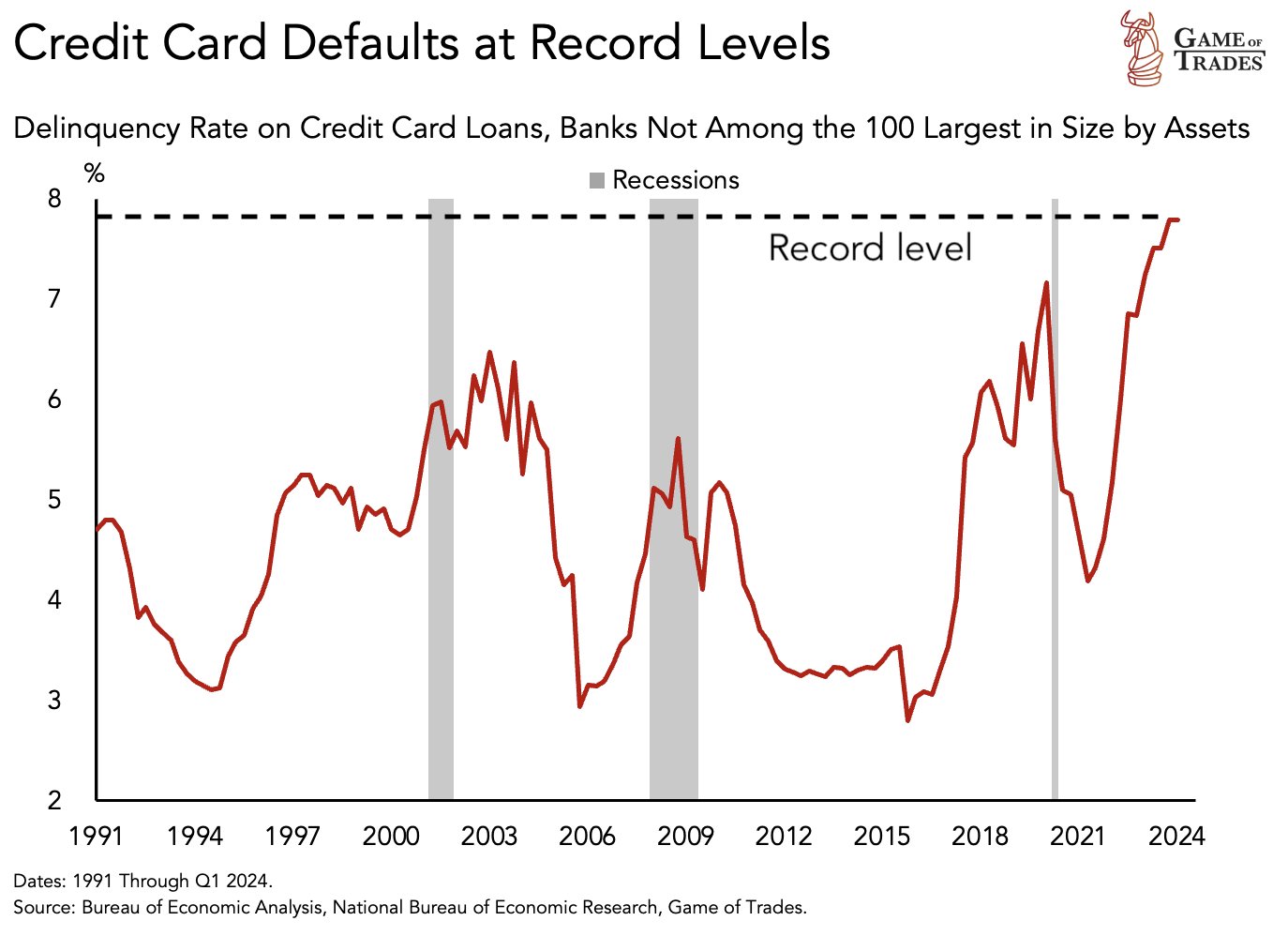

Oh wait, we stated “optimism in 2025!” Bank card debt ain’t that.

Nonetheless, the credit score debt drawback exhibits President Joe Biden left Trump an financial mess.

We’re in a scenario the place each consequence will be interpreted badly. If CPI is excessive, the market panics as a result of it assumes rates of interest will keep excessive and even get hiked. If CPI is low, it should scare everybody into pondering financial exercise is gradual, and the Fed must decrease charges, however getting the Fed to decrease charges is like pulling enamel.

Proper now, we’re within the “all information is unhealthy information” part, however there have been loads of occasions we’ve been within the “all news is good news” part, too.

Trump is the X issue. His first few months in workplace will decide the Bitcoin worth and the route of the financial system.

EXPLORE: Crypto Trends For Bullrun – January 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up Today’s CPI Report: Is a Major Bitcoin Price Correction Incoming? appeared first on 99Bitcoins.

[ad_2]

Source link