Days after 99Bitcoins voted Michael Saylor as essentially the most influential crypto persona for 2024, the previous CEO of MicroStrategy and a vocal Bitcoin advocate reignited hypothesis on X that the enterprise intelligence agency might, lower than per week after shopping for Bitcoin, stack much more cash.

Will MicroStrategy Purchase Extra Bitcoin in January?

On January 5, Saylor posted the SaylorTracker, a intently watched monitoring software buyers and Bitcoin

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d value motion

fanatics used to watch MicroStrategy’s BTC holdings.

One thing about https://t.co/Bx3917zMqi is just not fairly proper. pic.twitter.com/vRTAH2xTCX

— Michael Saylor

(@saylor) January 5, 2025

Following previous occasions, MicroStrategy might snag much more cash within the subsequent few days.

Traditionally, every time Saylor tweets concerning the tracker, MicroStrategy tends to purchase extra cash a number of days later.

Disconcerting blue traces on https://t.co/Bx3917zMqi. pic.twitter.com/xPl4GTKU3E

— Michael Saylor

(@saylor) December 29, 2024

On December 9, Saylor shared the tracker on X just for MicroStrategy to buy 2,138 BTC on December 30.

Based mostly on this sample, MicroStrategy might purchase extra cash as early as Wednesday, January 8.

EXPLORE: 10 Coins with High Returns: Crypto Forecast 2025

MicroStrategy Has A Bitcoin Plan

Based on Bitcoin Treasuries, MicroStrategy stays the most important public firm holding Bitcoin.

With 446,400 BTC price over $43 billion at spot charges stacked, the agency controls extra cash than the United States and China.

(Source)

Over the previous few years, they’ve been on a relentless shopping for spree, combining a novel technique dubbed the 21/21 plan.

The mission is to purchase extra cash by issuing extra fairness. Particularly, MicroStrategy plans to purchase $42 billion price of BTC by issuing $21 billion in fairness and an extra $21 billion in fixed-income securities.

Following a shareholder assembly in late December, in addition they plan to extend the variety of widespread shares from 330 million to 10.3 billion.

This month, MicroStrategy can also be looking to boost $2 billion by way of a perpetual most popular inventory providing. The providing, which goals to extend their liquidity additional, will probably be separate from the 21/21 plan.

They already bought $561 million of MSTR shares in early December. It used its proceeds to purchase 5,262 BTC at a mean value of $106,662.

Whereas some commentators frown on this plan, calling it speculative, it solely underscores MicroStrategy’s core perception that Bitcoin is a superior retailer of worth.

EXPLORE: Buying and Using Bitcoin Anonymously / Without ID

Will BTC Worth Reclaim $100,000 in January?

Given the sharp rally of MSTR inventory over the previous few years, MicroStrategy was included within the Nasdaq 100 index on December 23.

The inclusion was anticipated. Institutional buyers searching for crypto publicity by way of a regulated market more and more have used MicroStrategy as a de-factor Bitcoin proxy.

As Bitcoin pumps, MSTR inventory has been on an upward development. The surge from early November additional boosted MicroStrategy’s valuation.

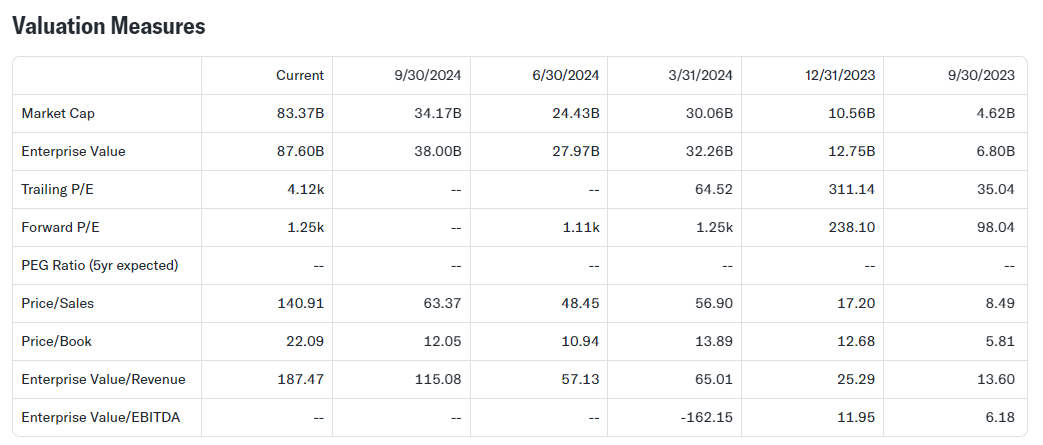

As of January 6, it stood at over $83 billion, based on Yahoo Finance market information.

(Source)

Apparently, MSTR inventory costs have soared in 5 years from lower than $15 to over $300, mirroring the sharp upturn in Bitcoin valuation.

Coupled with Trump’s pro-crypto insurance policies and optimism of MicroStrategy’s regular accumulation, costs might reclaim $100,000.

(BTCUSDT)

Bitcoin value is up almost 10% from December 2024 lows at press time. Even so, a robust breakout above $100,000 might drive costs to contemporary all-time highs.

DISCOVER: Crypto Trading In South Korea Surpasses Stock Market With $18 Billion In 24 Hour

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The submit Will MicroStrategy Buy More Bitcoin Today? Saylor Posts SaylorTracker Again appeared first on 99Bitcoins.